The luxury retail landscape is being reimagined, with brands moving beyond transactional spaces to offer curated lifestyle experiences, according to data analytics company Euromonitor International

In 2025, physical luxury stores accounted for 81% of personal luxury goods sales, reflecting the sector’s resilience and the continued importance of in-person engagement.

Euromonitor International’s World Market for Luxury Goods 2025 report highlights that the luxury market – valued at USD 1.5 trillion in 2025 – remains resilient, despite continued macroeconomic and geopolitical disruptions.

Referencing the latest findings within the Luxury Goods category from Euromonitor International’s Passport knowledge hub, Fflur Roberts, Global Insight Manager for Luxury Goods at Euromonitor International, said: “Amidst market uncertainty, the industry is undergoing a profound transformation, shifting from product-centric models to experience-driven engagement. Wellness, lifestyle and emotional resonance are emerging as new markers of status, reshaping how brands connect with consumers.”

India ranks in the top five for growth

Euromonitor International reports that South Africa (15%), India (10%), and the United Arab Emirates (9%) are among the leading countries in luxury goods market growth. India is emerging as a significant player in the global luxury goods market. The total market value is projected to be USD 12.1 billion by 2025.

The country is expected to achieve a Compound Annual Growth Rate (CAGR) of 74% over the forecast period, highlighting its growing importance in the luxury ecosystem. A key factor contributing to India’s growth is the increasing number of wealthy individuals.

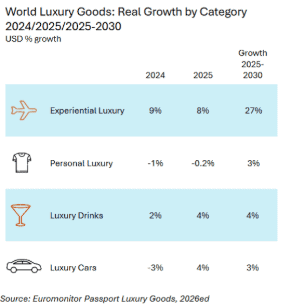

Premium and luxury cars led value sales, fuelled by urbanisation, affluent consumers, attractive financing, and new electric models. Experiential luxury—especially hotels, travel, fine dining, and exclusive events—was the fastest-growing segment, as younger buyers increasingly sought unique experiences over products, spurred by a surge in tourism and personalised offerings.

Human touch elevates retail

Physical luxury stores are becoming expressions of identity through exclusivity and hospitality. These environments mirror high-end hospitality, with concierge-level service and engaging storytelling.

Although digital channels are more personalised, many affluent consumers value human touch. According to Euromonitor’s Voice of the Consumer: Retail Survey 2025, 52% of high-income shoppers prefer shopping in-store for fashion – up from 36% in 2023 – highlighting renewed appreciation for tactile experiences that digital platforms cannot fully replicate.

While e-commerce surges, luxury brands are reimagining stores as cultural destinations that inspire, connect and reward loyalty through interactive experiences.

Lifestyle drives luxury evolution

Luxury spending has shifted from personal goods towards experience-led categories, reflecting deeper changes in consumer values. Experimental luxury showed resilience, with luxury travel and hospitality markets growing 8% in 2025 to reach USD 103 billion.

This momentum highlights a broader consumer pivot, where wellness, lifestyle and emotional connection are becoming new status symbols. The “third space” – environments beyond home and work – has evolved into dynamic hubs and wellness real estate that blend lifestyle, retail, and social experiences. These spaces offer exclusivity, community and personal fulfilment, prompting brands to expand into new verticals.

Ageing affluence fuels demand

The 60+ age group is rapidly growing in affluence and influence, driven by increased life expectancy, improved healthcare and a generational shift in lifestyle priorities. This cohort is redefining luxury – seeking indulgence and sophistication but also empowerment and simplicity.

Their spending favours luxury offerings that enhance quality of life – from wellness travel, spa-led hospitality and age-inclusive luxury skin care to home innovations, real estate and luxury retirement villages supporting “ageing in place”.

Roberts concludes: “For brands, this is a prime moment to rethink premium experiences through the lens of longevity and conscious indulgence, designing services that cater to a generation with time, resources and a growing appetite for elevated living. The luxury sector’s growth will depend on its ability to adapt to these evolving consumer opportunities.”

Read more: News