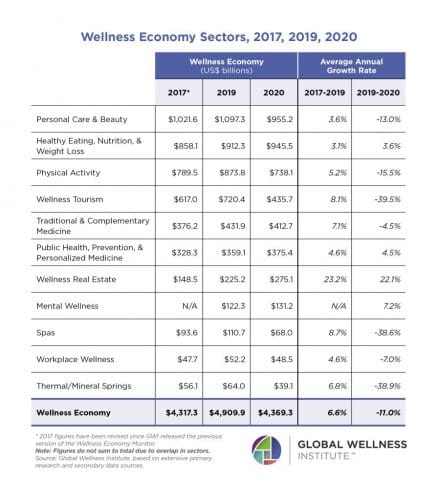

New Global Wellness Institute research reveals that the wellness market grew to a record $4.9 trillion in 2019 and then fell to $4.4 trillion in the pandemic year of 2020.

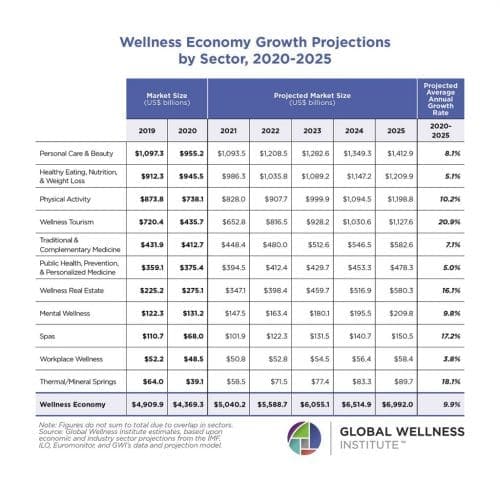

But with a consumer “values shift” underway, the future of the wellness market is incredibly bright, predicted to grow 10% annually through 2025.

The Global Wellness Institute (GWI) has released “The Global Wellness Economy: Country Rankings,” the first research to measure the wellness economies of 150 nations. The report is a companion to its recently-released global update on the wellness market, finding that the world wellness economy is worth $4.4 trillion and forecast to reach $7 trillion by 2025.

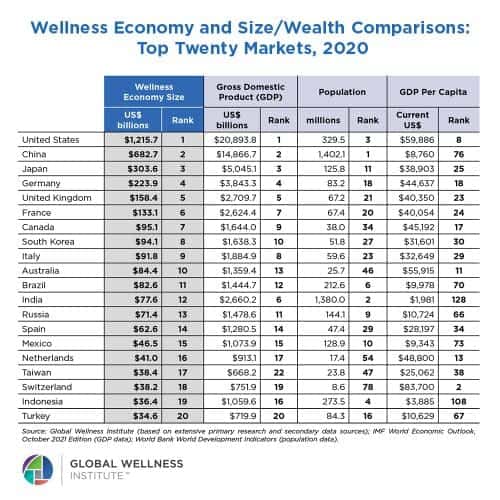

The Top 20 Wellness Markets

It’s no surprise the world’s most populous countries (e.g., China, India, Indonesia, Brazil, Russia), or the wealthiest (e.g., Switzerland, Australia, Netherlands), or countries that combine size with wealth (e.g., the US, Japan, Germany, the UK, etc.), spend the most on wellness.

The US is by far the largest market, at $1.2 trillion–nearly double the size of the second-largest market, China, at $683 billion. In fact, the US accounts for 28% of the entire global wellness market, while the top ten markets represent 71% of the world total.

Top 20 countries

US: $1.2 trillion

China: $683 billion

Japan: $304 billion

Germany: $224 billion

UK: $158 billion

France: $133 billion

Canada: $95 billion

South Korea: $94 billion

Italy: $92 billion

Australia: $84 billion

Brazil: $83 billion

India: $78 billion

Russia: $71 billion

Spain: $63 billion

Mexico: $46 billion

Netherlands: $41 billion

Taiwan: $38 billion

Switzerland: $38 billion

Indonesia: $36 billion

Turkey: $35 billion

Where Do Consumers Spend the Most on Wellness? (Wellness Spending Per Capita)

Consumers in the very wealthiest economies spend the most each year on wellness. Globally, the wellness economy represents 5.1% of total GDP, roughly 1 in every 20 “dollars” spent by consumers worldwide is on wellness.

Countries with Wellness Spending Per Capita

Switzerland: $4,372

Iceland: $3,728

US: $3,685

Austria: $3,568

Norway: $3,346

Australia: $3,771

New Zealand: $2,969

Denmark: $2,958

Hong Kong: $2,943

Aruba: $2,792

For Small, Tourism-Dependent Countries, Wellness Is an Outsized Percentage of Their Economy

It may seem surprising to see Aruba rank in the top 10 for consumer spend on wellness, as it’s not as wealthy as the other ranked countries. This is the tourism effect, where high-spending inbound wellness tourists represent a disproportionate part of the wellness market. The report ranks countries by the ratio of the size of their wellness economy to the size of their total GDP/economy, and the small, tourism-dependent countries really stand out.

For those top five nations, the wellness market represents an eye-opening percentage of total GDP: Seychelles (16.5%), Maldives (14.5%), Aruba (11.9%), Costa Rica (11.4%), and St. Lucia (10%). This is a window into the powerful contribution that wellness tourism brings to their economies, but also shows how in these small countries wellness is more of an “export industry” and for the most part out of reach of locals.

The Sectors That Define National Wellness Markets Vary Dramatically

Both worldwide and in most countries, the wellness market is concentrated in three sectors: 1) healthy eating, nutrition, and weight loss; 2) personal care and beauty; and 3) physical activity. These three segments account for more than 60% of the total wellness market.

There is however a wide national and regional variance. In Japan, personal care/beauty represents a much bigger share of wellness spending than in most countries; for China, India, Indonesia, Russia, and Turkey, it’s traditional/complementary medicine; in Germany, it’s wellness tourism, spas and thermal/mineral springs; while in Sub-Saharan Africa, public health and prevention spending dominates.

Wellness Market Snapshots:

Wellness Tourism (pandemic loser, future winner): Grew 8% annually from 2017 to 2019 (reaching $720 billion) and then took a major hit in 2020. The market shrunk -39.5% to $436 billion, while wellness trips dropped from 936 million to 601 million. The impressive 21% annual growth rate projected for wellness tourism through 2025 reflects new traveler values (a quest for nature, sustainability, mental wellness) as well as a period of rapid recovery from pent-up demand in 2021 and 2022.

Thermal/Mineral Springs (pandemic loser, future winner): One of the fastest-growing wellness markets from 2017 to 2019, with revenues rising from $56 billion to $64 billion (6.8% annual growth). Hit hard by the pandemic, revenues fell -39% in 2020, shrinking the market to $39 billion. There are now 35,099 hot springs establishments across 130 countries. The downturn is temporary: Very strong 18% annual growth is expected through 2025, with 140-plus new projects in the pipeline.

Spas (pandemic loser, future winner): From 2017 to 2019, the spa industry was growing at a fast 8.7% annual rate and reached $111 billion in revenues across 165,714 spas–with a big jump in hotel/resort spas (from 48,248 to 60,873). The high-touch industry got hit hard in 2020: Revenues fell by -39% (to $69 billion) and spa establishments dropped to 160,100 (with a loss of over 4,000 day spas). But the industry is expected to recover fast, with the market growing 17% annually through 2025, and more than doubling revenues (to $150.5 billion).

Wellness Real Estate (pandemic and future winner): With COVID-19 dramatically accelerating the understanding of the role that the built environment and our homes play in our physical and mental health, the wellness real estate market was the #1 growth-leader both before and during the pandemic: The market grew from $148.5 billion in 2017 to $225 billion in 2019 to $275 billion in 2020 (22% annual growth). Wellness residential projects (either built or in the pipeline) skyrocketed from 740 in 2018 to over 2,300 today. Wellness real estate will continue its growth surge: The market will double to $580 billion from 2020 to 2025 (16% annual growth).

Physical Activity (pandemic loser, future winner): This six-sector market grew 5% from 2018-2019 (to reach $874 billion), but revenues fell 15.5% in 2020 (to $738 billion). The fitness subsector (gyms, studios, classes) suffered a severe -37% revenue decline in 2020. Fitness technology was, of course, the bright spot, exploding 29% in 2020 to become a $49.5 billion market–with digital apps, streaming and on-demand workout platforms surging 40%. The segment’s hybrid bricks-and-mortar/digital future is bright: the market will nearly double–from $738 billion to $1.2 trillion–from 2020-2025.

Mental Wellness (pandemic and future winner): Posted strong 7% growth from 2019-2020 (from a $122 billion to a $131 billion market), as consumers desperately sought solutions to help them cope with pandemic stresses. The largest segment, “senses, spaces and sleep,” grew 12.4%, while the smallest segment, meditation and mindfulness, grew the fastest (25%). The forecast: strong 10% growth annually through 2025, to reach $210 billion.

Personal Care & Beauty (pandemic loser, future winner): Consumer spending expanded from $1 trillion in 2017 to $1.1 trillion in 2019, and then declined by 13% to $955 billion in 2020. In 2020, Asia-Pacific moved from being the third to the first-ranked market. Spending will bounce back post-pandemic, with 8.2% annual growth through 2025, to reach $1.4 trillion.

Traditional & Complementary Medicine (pandemic loser, future winner): This market spans different holistic, indigenous, ancient therapies and products (acupuncture, Ayurveda, Traditional Chinese Medicine, chiropractic, etc.). It grew from $376 billion in 2017 to $432 billion 2019, but contracted to $413 billion in 2020. It will see healthy 7% annual growth from 2020-2025, reaching $583 billion.

Healthy Eating, Nutrition & Weight Loss (pandemic and future winner): One of the few wellness sectors that maintained positive growth (3.6%) during the pandemic, which launched a wave of interest in home cooking, healthy food, and immunity-focused foods and supplements. The sector grew from $858 billion in 2017 to $912 billion in 2019 to $945.5 billion in 2020–and is forecast to grow 5% annually through 2025, to reach $1.2 trillion.

Public Health, Prevention & Personalized Medicine (pandemic and future winner): Another sector that saw positive pandemic growth (4.5%), largely because many governments and healthcare systems ramped up their public health and prevention expenditures during the COVID-19 crisis. The sector grew from $328 billion in 2017 to $359 billion in 2019 to $375 billion in 2020 (when it represented about 4% of total global health expenditures at $8.8 trillion).

With painful lessons from the pandemic about the terrible costs of underinvesting in public health, the segment is forecast to grow 5% annually through 2025–to reach $478 billion.

Workplace Wellness (pandemic loser, future winner, with a difference): This segment grew 4.6% annually from 2017 to 2019–reaching a market high of $52.2 billion–but then shrank 7% in 2020, to $48.5 billion. Companies are recognizing that a compartmentalized, programmatic approach to employee wellbeing is not particularly effective in tackling the rising challenges of stress, work-life balance, and mental health, so many are shifting to more meaningful, holistic approaches encompassing everything from changing company culture to focusing on the built environment.

These expenditures cannot be measured as “workplace wellness,” so expenditures may decline even as the focus on employee wellbeing actually expands. Even so, the market is pegged to grow 4% annually through 2025, reaching $58.4 billion.

“The wellness economy will grow to $7 trillion in 2025, because the forces that have been driving it remain as powerful as ever: an expanding global middle class, an aging population, and rising chronic disease,” said Katherine Johnston, GWI senior research fellow.

She added, “But the pandemic has brought new shifts and a global ‘values reset’: ‘Wellness’ now means far more than a facial or spin class, with a growing focus on mental wellbeing and the importance of work-life balance, social justice, environmental sustainability, the built environment, and public health. These drivers will underpin the recovery of the wellness economy; they will also shift consumer, policy and healthcare spending in new directions.”

Read More: Latest