Leela Palaces Hotels & Resorts Limited (formerly Schloss Bangalore Limited) has announced its financial and operational results for the quarter ending December 31, 2025 (Q3 FY26)

The Company delivered its fifth consecutive quarter of double-digit revenue per available room (RevPAR) and EBITDA growth, continuing to materially outperform the Indian luxury hotel segment.

Commenting on the results, Anuraag Bhatnagar, Whole-time Director and Chief Executive Officer, said, “We delivered our best-ever quarterly performance in Q3 FY26 with total operating revenue growing 21% to ₹4,574 million, reaffirming our unique luxury positioning and ability to command pricing power, substantially outpacing India’s luxury industry by nearly 2.7x on a year-to-date basis. We also advanced our strategy of disciplined, capital-efficient growth by signing a management agreement for The Leela Jaisalmer and our first international strategic investment in Dubai.”

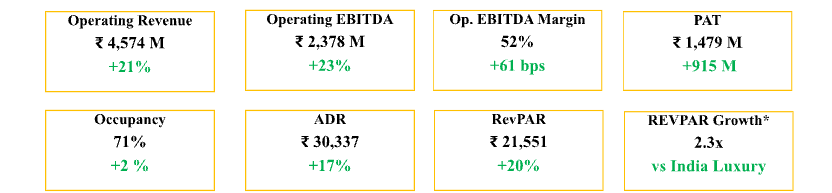

Key consolidated Financial Results Q3 FY25-26 (YOY)

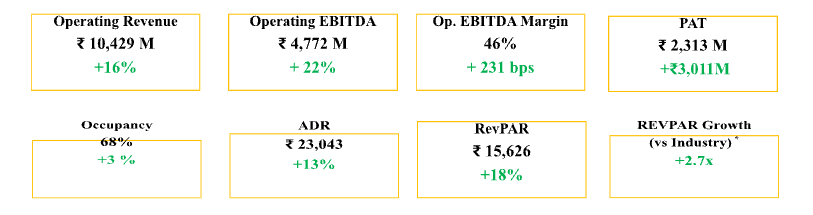

Key consolidated Financial Results 9M FY25-26 (YOY)

Quarterly Financial Operations Performance

- Operating revenue grew 21% year-on-year to ₹4,574 million, while operating EBITDA increased 23% to ₹2,378 million and profit after tax ( PAT) surged 162% to ₹1,479 million, marking the best ever quarterly performance.

- EBITDA margins expanded by 61 basis points to 52% in Q3 FY26, driven by strong operating leverage and disciplined cost management. For 9M FY26, over 60% of incremental operating revenue flowed through to EBITDA, reflecting sustained efficiency and scalability of the operating model.

- RevPAR grew 20% to ₹21,551, reflecting industry-leading performance and strong pricing power, outperforming the India luxury segment by ~2.3x during Oct’25 to Nov’25.

- Outsized growth across revenue streams, with Room Revenue up 20% driven by higher retail (+18%) and group (+45%) contributions led by weddings, and F&B Revenue up 29% supported by strong banqueting and MICE demand.

- Brand.com (direct bookings) surged 153% YoY, enhancing direct-to-consumer economics and margin profile.

- Fifth consecutive quarter of double-digit RevPAR and EBITDA growth, underscoring portfolio resilience and sustained market momentum.

Industry – Leading Brand Recognition and NPS Leadership

- Net Promoter Score (NPS) of 86 in 9M FY26, substantially exceeding luxury segment benchmarks1 (76), validating commitment to service excellence and guest experience differentiation.

- Global recognition reinforcing brand strength: For the sixth consecutive year The Leela was named The Best Hotel Group in India by Travel+Leisure India & South Asia.

Hotels continued to win global accolades including Robb Report Hong Kong – Best in India, Best of the Best Travel 2026 (The Leela Palace Udaipur); Michelin Keys awarded to three palaces (New Delhi 2-Key, Jaipur 2-Key, Chennai 1-Key); Condé Nast Traveler Readers’ Choice Awards UK and USA recognizing The Leela Kovalam, A Raviz Hotel, as #1 Best Resort in India, with four of five palaces ranked among India’s finest hotels.

1 – Industry average of 76 for CY 2024 for luxury segment in APAC region

Disciplined Capital-Efficient Expansion: 1000+ keys

The Leela executed two strategically significant additions during Q3, reinforcing commitment to disciplined, capital-efficient value creation:

- Domestic Expansion – The Leela Jaisalmer:

- Secured management contract for 80-key luxury hotel in Jaisalmer spread across 30 acres, scheduled to become operational by mid-FY27.

- Strengthens The Leela’s dominant presence in Rajasthan, creating compelling four-property circuits across Jaipur, Udaipur, Ranthambore, and Jaisalmer with demonstrated cross-selling synergies.

- Strategic Global Expansion – Dubai Palm Jumeirah:

- Completed acquisition of 25% equity stake in iconic 23-acre luxury beachfront resort on Palm Jumeirah, marking Leela’s first international foray.

- Total equity investment of approximately $70 million (including capex), expected to be fully recovered within 2-3 years through branded residence monetization – an effectively asset-light investment. Equity participation secures continuity of HMA contract with no key money, expected to generate approximately ₹670 million in annual management fees upon stabilization, plus profit-share participation. Transaction enhances global brand visibility and network effects while creating sustainable long-term shareholder value.

The Leela currently operates 14 properties with 4,090 keys across 12 cities in India, including 6 owned, 7 managed, and 1 franchised hotel. With 9 hotels now in the pipeline, it is on track to expand to 23 properties over the next three years in high-growth markets including Agra, Ayodhya, Bandhavgarh, Mumbai, Ranthambore, Sikkim, Srinagar and now Jaisalmer.

Strengthened Balance Sheet and Financial Flexibility

- Enhanced financing efficiency through term loan renegotiation, reducing interest rates from 9.1% to 8.25%, lowering borrowing costs and enhancing PAT and Return on Equity.

- Strong balance sheet with ample headroom to fund future growth while maintaining conservative leverage profile.

Long-Term Value Creation Target

Company reiterates its EBITDA target of ₹20,000 million by FY30, anchored in four clear growth pillars:

- Same-store growth supported by sustained ADR expansion, occupancy improvement and operating leverage over the next 2-3 years

- New verticals including Arq By The Leela, curated F&B, wellness and experiential offerings enhancing TRevPAR and guest lifetime value.

- Owned hotel developments in high-barrier markets creating long-term asset value.

- Capital-light management contracts and strategic investments expanding the brand footprint while maximizing returns on invested capital.

Read more: News