Royal Orchid Hotels has reported improved financials and increased assets, led by strong regional performance

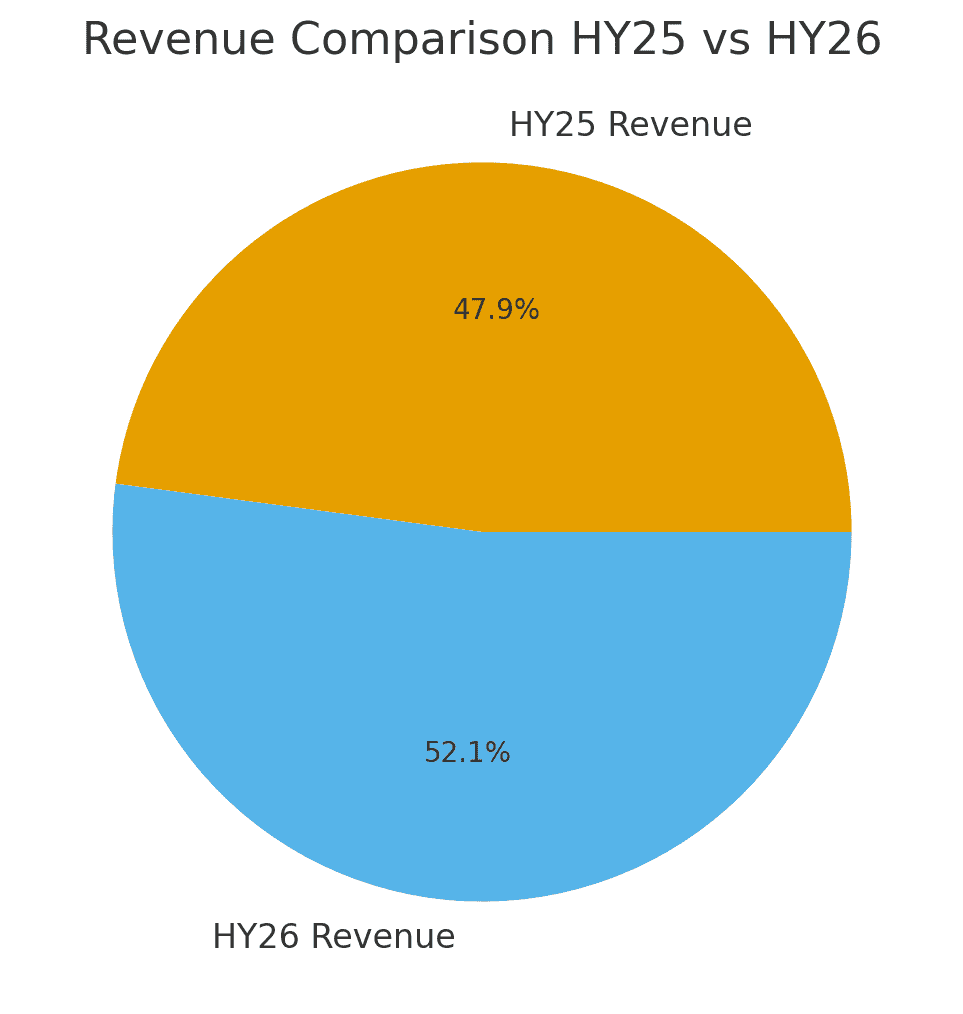

Royal Orchid Hotels Ltd has released its financial results for the quarter and half year ending September 2025, reporting steady growth supported by an expanding national portfolio. Consolidated income for the half year rose to INR 169.57 crore, reflecting an eleven percent increase over the same period last year. The results were approved by the Board of Directors in Bengaluru on 13 November 2025.

Strong Financial Performance and Operational Progress

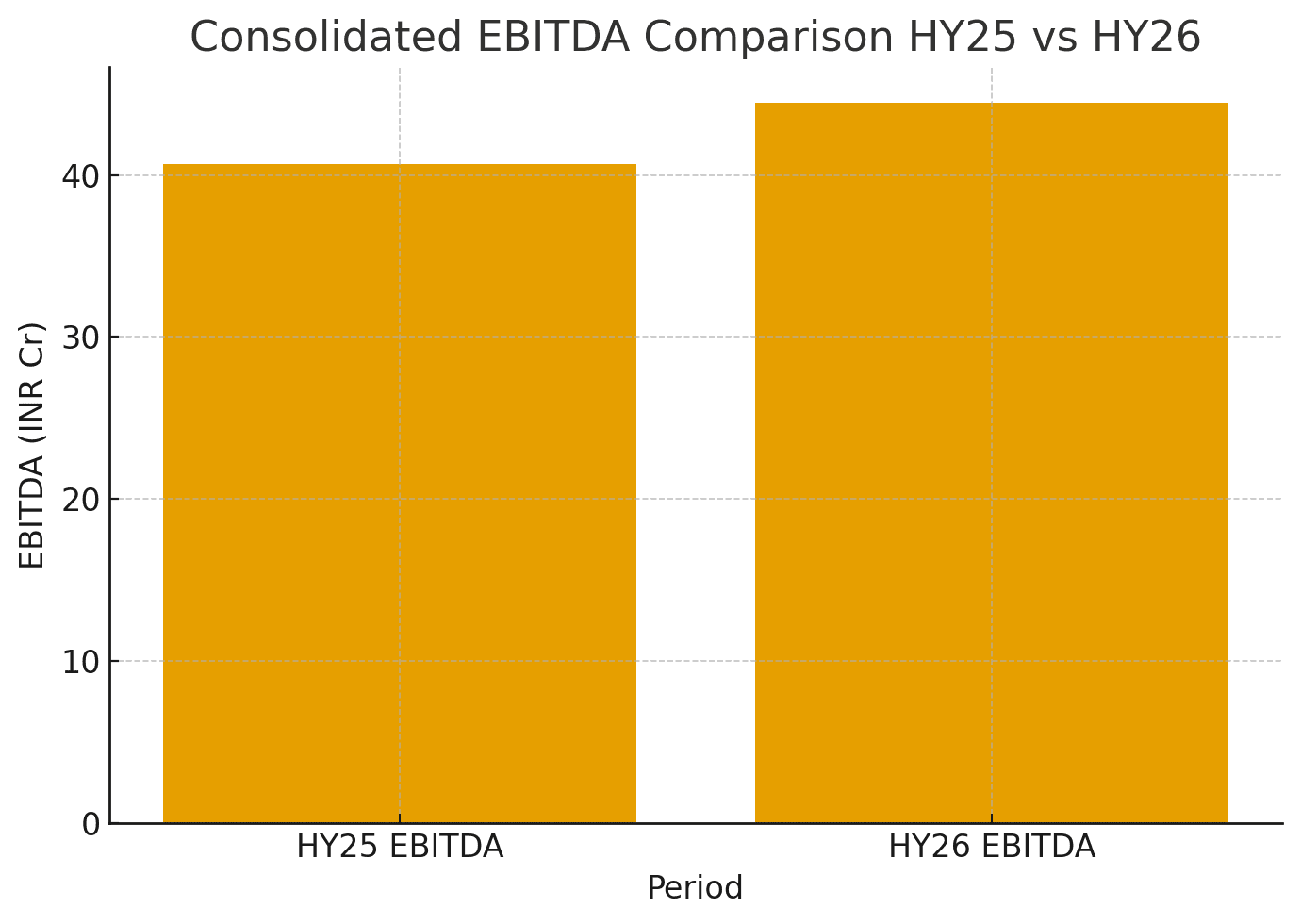

The company posted consolidated EBITDA of INR 44.46 crore for the half year, an increase of nine percent. The adoption of IND AS 116 contributed to a notional rise in depreciation and finance costs amounting to INR 6.35 crore, largely because of investment in Iconiqa Mumbai. The hotel has now commenced operations and marks an important development for the group.

Chander K Baljee, Chairman and Managing Director, said, “We are pleased to report balanced portfolio growth across regions, with an increase in revenue over the same period last year and the addition of 6 new properties during this quarter. Reinforcing our commitment to strategic growth, we have opened Iconiqa Mumbai in record time, and within an unprecedented budget. We are continuing our strong expansion across 5 brands with over 30 hotels opening in the near future, well on target to meet our 2030 goals.”

Expanding Portfolio Driven by the Regenta Brand

Royal Orchid Hotels now operates more than one hundred properties under the Regenta brand, covering segments that serve business and leisure travellers across India. Regenta remains the company’s principal driver of growth, supported by a development pipeline that spans key destinations and emerging markets. Regenta Rewards, the new loyalty programme, will bring all current and upcoming hotels onto a unified customer platform.

Read more – News