The Leela Palaces Hotels & Resorts Limited (formerly Schloss Bangalore Limited) has announced its financial and operational results for the quarter ending September 30, 2025 (Q2 FY26)

Commenting on the results, Anuraag Bhatnagar, Chief Executive Officer, said: “We delivered a robust performance in Q2 FY26 with total revenue growing 11% to ₹3,334 million, EBITDA rising 17% to ₹1,607 million, and PAT growing to ₹747 million. This marks our fourth consecutive quarter of positive PAT, underscoring the strength of our business. RevPAR grew 13% reflecting industry-leading performance, driven by improved occupancy and ADR, with owned hotels posting strong double-digit RevPAR growth across both city and resort segments.”

He added, “We remain on track to deliver mid-to-high teens EBITDA growth for FY26, supported by robust operating momentum, strategic initiatives, and continued portfolio enhancements. We are also very excited to announce our international foray with entry into Dubai’s Palm Jumeirah, a top luxury tourist destination, extending The Leela’s hospitality on a global stage.”

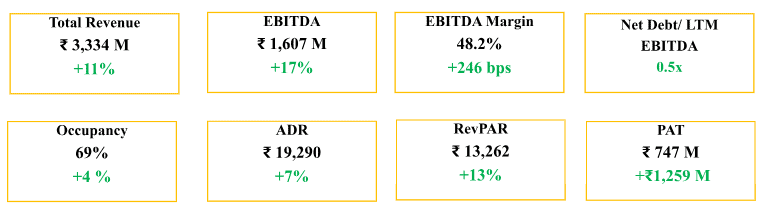

Key consolidated Financial Results Q2 FY25-26 (YOY)

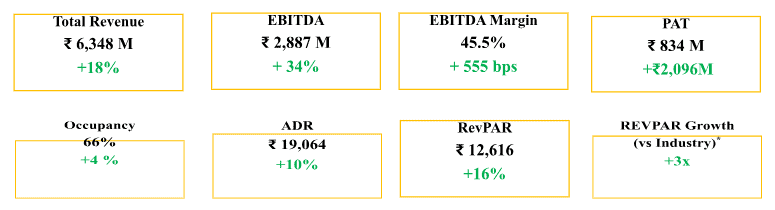

Key consolidated Financial Results H1 FY25-26 (YOY)

*Industry refers to India Luxury Segment. Data for the period April-August 2025.

ROBUST FINANCIAL AND OPERATIONAL PERFORMANCE IN Q2 / H1

- Total revenue grew 11% year-on-year to ₹3,334 million, while EBITDA increased 17% to ₹1,607 million and PAT growing to ₹747 million.

- EBITDA margins expanded to 48.2% driven by operating leverage and improved cost management.

- Strong operational performance with same-store portfolio delivering robust operating leverage with 77% flow-through to EBITDA for H1 FY25-26.

- RevPAR grew 13% to ₹13,262, reflecting industry-leading performance, driven by higher occupancy and ADR growth, demonstrating customers’ continued willingness to pay a premium for The Leela experience – reflected in best-in-class net promoter score of 86.

- RevPAR growth outperformed luxury segment across all markets with 3x market benchmark growth in H1 FY26.*

Continued strategic expansion and brand enhancement

The Leela currently operates 13 properties with 3,544 keys across 11 cities in India, including 5 owned, 7 managed, and 1 franchised hotel. With 9 hotels in the pipeline, it is on track to expand to 22 properties over the next three years in high-growth markets including Agra, Ayodhya, Bandhavgarh, Mumbai, Ranthambore, Sikkim, Srinagar and now Dubai.

- Strategic Global Expansion: Received board approval to sign binding agreements to acquire a 25% stake in a luxury beachfront resort in Dubai’s iconic Palm Jumeirah. Private funds, managed by Brookfield, will acquire the balance 75% stake. For its 25% equity stake, The Leela will require upfront capital of c. $49M / c. ₹4,370 million. Upon conversion to “The Leela”, this will mark the brand’s first international foray. The Resort is spread across 23 acres on one of the largest freehold beachfront land plots in Dubai, and comprises of 546 keys including a 361 key hotel, 182 residences and 3 villas.

- Trophy Beachfront Location: The Palm Jumeirah is one of the most well-established and supply constrained luxury hospitality destinations in the world, with more than 5 million annual tourists and the highest concentration of $1M+ homes in Dubai.1

- Attractive Investment Economics: The purchase price of $503 million, implies an entry multiple of 12.8x on estimated CY 2025 EBITDA and c.7.0x on stabilized 2030 EBITDA, significantly accretive to The Leela.2

- Fast Equity Recycling: 100% of The Leela’s equity is expected to be returned within 2-3 years through sale of branded residences.

- Domestic Expansion and Asset Enhancement

- The Leela Palace BKC Structure Update: Leela BKC Holdings Private Limited will seek regulatory approvals to demerge the office business of the Mumbai BKC mixed-use development. Under the revised structure, The Leela will retain and fund a 50% stake in the hotel component, while Brookfield will fund the remaining 50% of the hotel and fully fund and own the 0.7 million square feet office space. This approach enables The Leela to focus capital and operational resources on the hotel business, while optimizing capital allocation across a broader range of accretive investment opportunities.

- ARQ by The Leela: Successfully launched the ultra-exclusive, invite-only members club at The Leela Palace Bengaluru in September 2025, with New Delhi and Chennai launches planned for H2 FY26.

- Luxury Retail Enhancement: Launch of the revamped c. 34,000 square feet luxury retail wing at The Leela Palace Bengaluru with anchor tenants like Sabyasachi and Zoya, is expected to generate over ₹100 million revenue annually.

Strengthened Balance Sheet and Financial Flexibility

- Post-IPO balance sheet strengthening continues with net debt to LTM EBITDA at 0.5x, providing significant financial flexibility for growth initiatives.

- Enhanced financing efficiency and strategic refinancing have strengthened financial flexibility and liquidity position — with the cost of debt reduced to 8.4% (from 9.1%), extended loan tenure, and an upgraded credit rating to AA (Stable).

Outlook

The Company remains well-positioned to deliver mid-to-high teens EBITDA growth in FY26, supported by:

- Strong same-store growth through increased direct business and optimal channel mix.

- Healthy macro tailwinds on luxury demand in key Leela markets.

- Disciplined cost management and operating leverage improvement.

- Continued portfolio enhancements

Read more: News