Mahindra Holidays & Resorts India reports steady growth across membership, resorts, and inventory expansion initiatives

Mahindra Holidays & Resorts India reported its standalone and consolidated financials for the quarter ending 31 December 2025.

During the quarter, the Company launched a new simplified and flexible membership product, KEYSTONE. Resort revenue recorded double-digit growth at Rs 125 crore, reflecting a 16 per cent year-on-year increase, with occupancy at 81.5 per cent. The Company added new managed resorts at Amba Ghat, Kolhapur in Maharashtra, Bandhavgarh National Park in Madhya Pradesh, and Corbett National Park in Uttarakhand. The room inventory base crossed the 6,000-key mark with the addition of 273 keys.

Membership Sales Value stood at Rs 145 crore, with Average Unit Realisation at Rs 9.7 lakh, up 58 per cent year on year. The Company added 1,493 new members during the quarter, taking the cumulative member base to 3,04,351. The cash position was Rs 1,470 crore as on 31 December 2025, while deferred revenue stood at Rs 5,754 crore. The figures for resort revenue include all subsidiaries except HCRO.

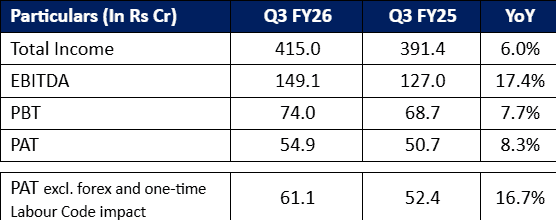

Under Indian Accounting Standards, MHRIL’s standalone total income for Q3 FY26 was Rs 415.0 crore compared with Rs 391.4 crore in Q3 FY25, registering a year-on-year growth of 6.0 per cent. EBITDA increased to Rs 149.1 crore from Rs 127.0 crore, a growth of 17.4 per cent. Profit before tax rose to Rs 74.0 crore from Rs 68.7 crore, while profit after tax stood at Rs 54.9 crore compared with Rs 50.7 crore in the corresponding quarter last year. Profit after tax, excluding forex and one-time labour code impact, was Rs 61.1 crore versus Rs 52.4 crore, reflecting a growth of 16.7 per cent.

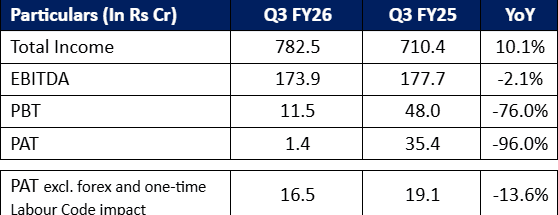

On a consolidated basis under Indian Accounting Standards, total income for Q3 FY26 stood at Rs 782.5 crore compared with Rs 710.4 crore in Q3 FY25, a year-on-year increase of 10.1 per cent. EBITDA was Rs 173.9 crore against Rs 177.7 crore, reflecting a decline of 2.1 per cent. Profit before tax declined to Rs 11.5 crore from Rs 48.0 crore, while profit after tax stood at Rs 1.4 crore compared with Rs 35.4 crore in the previous year. Profit after tax, excluding forex and one-time labour code impact, was Rs 16.5 crore versus Rs 19.1 crore, reflecting a decline of 13.6 per cent.

Commenting on the performance, Manoj Bhat, Managing Director and Chief Executive Officer, Mahindra Holidays & Resorts India, stated, “We had a good quarter with revenue up 10 per cent year on year. This was led by strong resort revenue growth of 16 per cent year on year in our India business. Our journey of premiumization continued with the launch of the simplified and flexible new membership product, KEYSTONE.”

He continued, “This product has found a good initial response from our prospects and members. Membership upgrades continued their strong momentum, achieving double-digit growth over the year. In line with our inventory expansion strategy, we added three new resorts during the quarter and added 273 rooms to our inventory base. Our India standalone business profits grew 8 per cent despite an exceptional charge on account of the labour code changes. Our European operations, HCRO has been impacted by economic headwinds and adverse weather conditions in Finland, which have had a negative impact on consolidated profitability. We continue to pursue our strategy of scaling the core and building the new.”

Read More: News

1 Comment