Indian Hospitality Sector Gears Up for a High-Growth Future

Indian hospitality sector closed 2024 with renewed vigour, posting strong operational metrics and reflecting a maturing market profile. As highlighted by Mandeep S. Lamba, President & CEO (South Asia), HVS ANAROCK, “India is transitioning from a nascent hotel market towards a more mature one, and it is going to be an exciting time as this transition takes place over the next decade or so.” The sentiment across the industry is clear: the growth story is no longer a rebound narrative. It is a long-term structural opportunity backed by demographic tailwinds, investor confidence, and evolving travel behaviour.

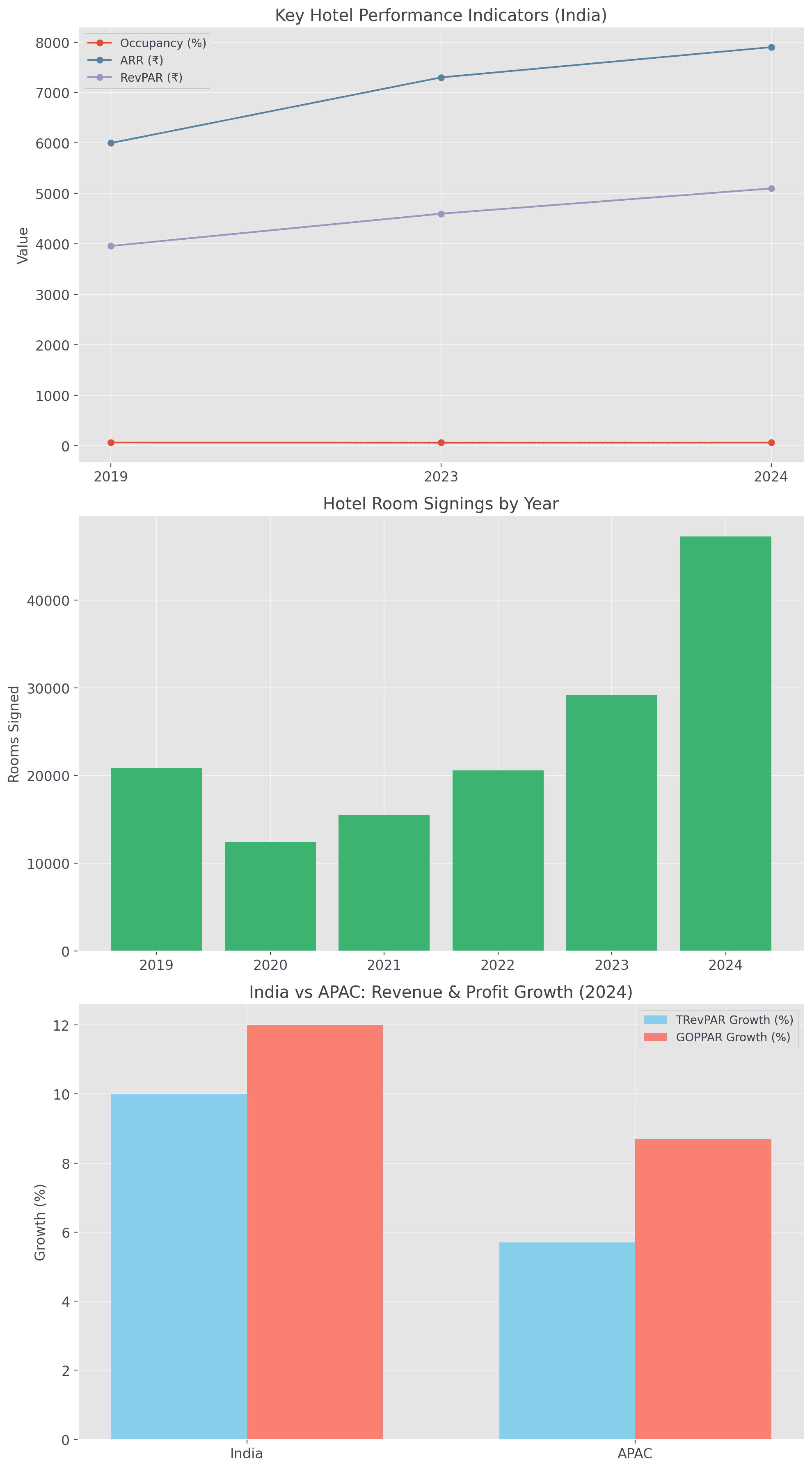

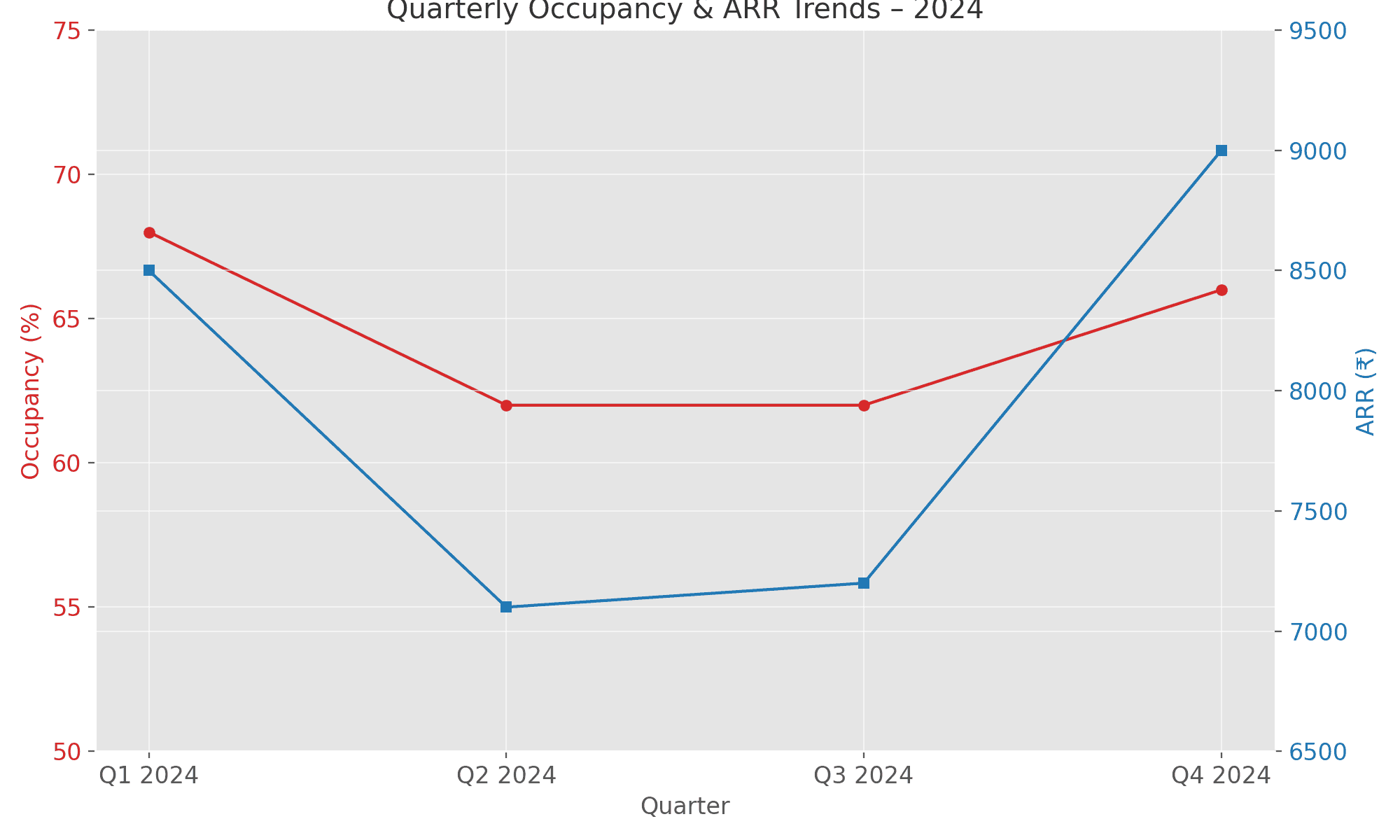

Performance indicators tell a compelling story. Occupancy levels stabilised between 63 to 65 percent, while the average room rate (ARR) touched ₹7,800–8,000. Revenue per available room (RevPAR) increased to ₹5,000–5,200, representing a 10–12% year-on-year increase and a 27–29% jump compared to pre-pandemic benchmarks. Profitability also saw an upward trend, with gross operating profit margins improving by 0.8 percentage points to reach 46.4%.

While global headwinds — including geopolitical instability and fluctuating economic sentiment — persisted, India’s domestic demand remained resilient, supporting growth in both occupancy and rate. As the report puts it, “The outlook for India’s hospitality sector in 2025 is not just optimistic; it’s electric.”

Demand-Led Momentum: What Powered 2024

Three key pillars underpinned India’s hospitality performance in 2024: spiritual travel, social events, and entertainment-led tourism.

Faith-based tourism emerged as a volume anchor, catalysed by landmark events such as the grand inauguration of the Ram Mandir in Ayodhya. The city witnessed 135.5 million domestic visitors, surpassing even the Taj Mahal in footfall. This trend extended across other spiritual centres—Prayagraj’s Maha Kumbh hosted 660 million visitors over 45 days, while Varanasi and Tirupati welcomed millions more. The report aptly notes, “This spiritual revival spans across the country.”

Simultaneously, India’s wedding segment transformed into an engine of experiential luxury. High-profile celebrations, notably the Ambani-Merchant wedding in Mumbai, redefined luxury hospitality with a reported spend of USD 600 million. Destination weddings grew at an estimated 20–25% annually, with average budgets reaching ₹51.1 lakh. These events played a significant role in driving occupancy and rate in luxury properties across Rajasthan, Goa, Kerala, and other scenic destinations. As the report observes, “India says ‘I do’ with a view.”

Another standout trend was the integration of live entertainment with hospitality performance. Concert-related travel surged by 44%, fuelled by global artists such as Coldplay, Dua Lipa, and Bryan Adams. Cities hosting these events experienced a direct uplift in bookings, with the report estimating annual spending on live entertainment at ₹1,600–2,000 crore, of which 25% went to hotels and transport.

Corporate travel also held its own, with India’s business travel spend reaching USD 38.2 billion in 2024—making it the ninth-largest market globally. The MICE segment benefited from India’s G20 momentum, while blended travel (a mix of business and leisure) gained ground among SMEs and younger professionals.

A Historic Year for Hotel Development

On the development front, 2024 was nothing short of transformational. India recorded its highest-ever hotel signings, with 47,249 keys added to the pipeline—a 62% increase from the previous year. This included 382 new properties and 102 rebranded hotels. The average key count per signed property also rose to 98 rooms, driven by a shift toward larger-format developments.

Hotel operators pursued a dual-pronged strategy: greenfield expansions into underserved leisure and spiritual markets, and brownfield developments in metro and mini-metro locations. Tier 3 and Tier 4 cities accounted for 46% of the keys signed, demonstrating a clear move toward decentralised growth. The report notes, “Domestic hotel operators accounted for 66% share of keys signed in Tier 3 & 4 markets,” while international brands focused more on Tier 1 cities and premium segments.

Investments followed suit. Transaction values totalled approximately USD 348 million in 2024. Major deals included Chalet Hotels’ acquisition of Courtyard by Marriott Aravali and Juniper Group’s Bengaluru airport property buyout. Notably, Mumbai and Bengaluru dominated, accounting for over 60% of total transaction value.

Investor confidence extended to capital markets. The year saw a flurry of IPOs — from Juniper Hotels and Apeejay Surrendra Park Hotels to Blackstone-backed Ventive Hospitality. The momentum was crowned by the demerger of ITC Hotels, which debuted on the bourses on January 29, 2025. Looking ahead, Schloss Bangalore (The Leela) and Brigade Hotel Ventures are scheduled for their public offerings, further solidifying the sector’s attractiveness.

Regional Market Performances

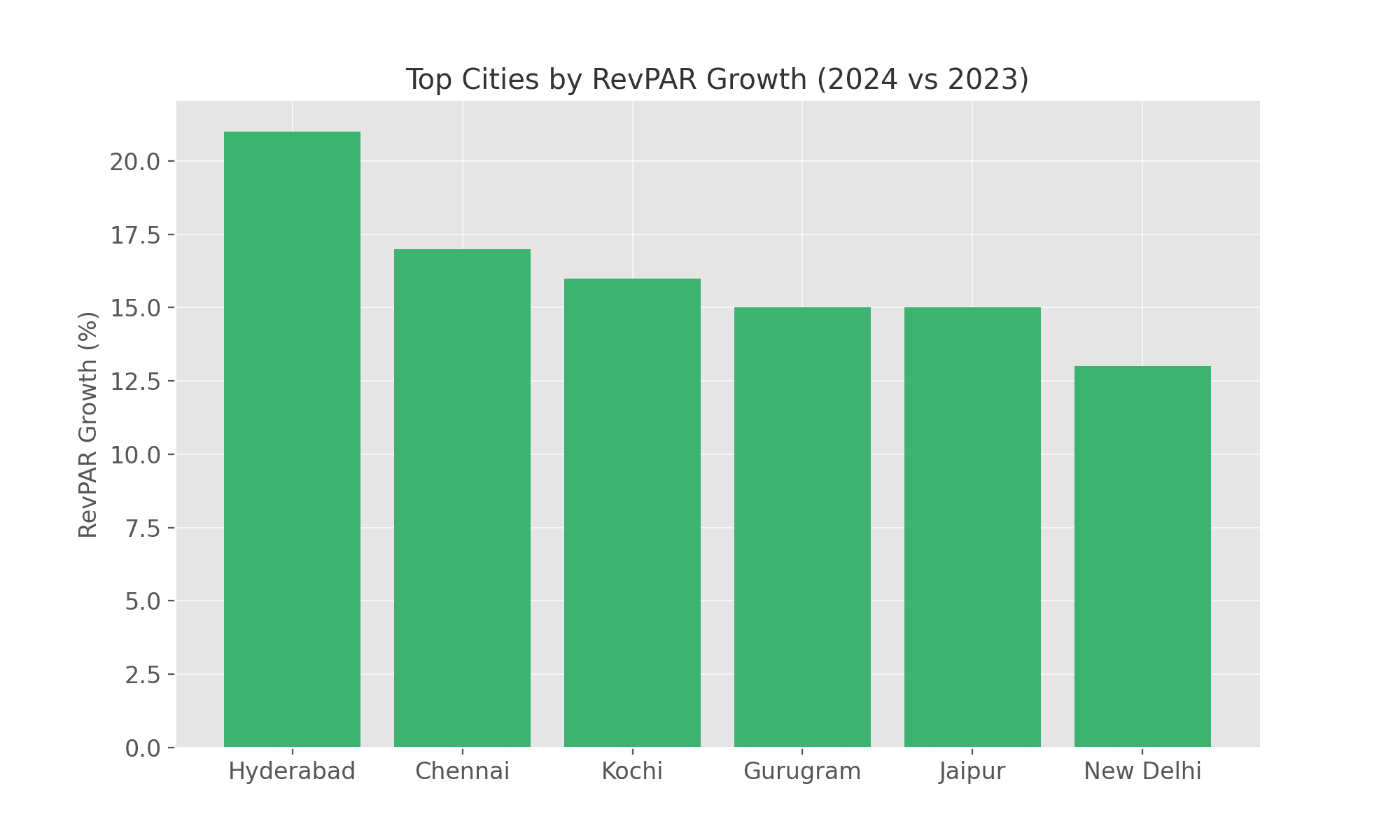

Among India’s top 13 hospitality markets, Hyderabad led in RevPAR growth with an increase of 20–22%. The city benefited from limited new supply and robust demand from the tech and GCC sectors, positioning it as a compelling alternative to Bengaluru. Kochi followed closely, evolving into a dual-purpose market serving both leisure and MICE. As the report remarks, “Kochi’s prominence in the MICE space has grown, driven by a rise in pharmaceutical, medical, and industry conferences.”

Mumbai maintained its leadership status across occupancy and ARR, boosted by high-profile events, corporate travel, and premium social gatherings. The city saw notable rate spikes, particularly in the Bandra-Kurla Complex (BKC) during the Ambani wedding. Goa, while still India’s dominant leisure destination, saw a minor RevPAR dip due to oversupply and outbound competition from Southeast Asia. However, its long-term growth remains intact, thanks to infrastructure improvements and air connectivity via the MOPA and Dabolim airports.

Sector Outlook: 2025 and Beyond

The momentum is expected to continue. A GM sentiment survey conducted by HVS ANAROCK reveals that 69% of hotel executives anticipate higher occupancy in 2025 compared to 2024. Meanwhile, 77% forecast ADR growth, with 51% expecting a 5–10% increase. The majority see room revenue as their strongest performing stream, followed by events and banqueting.

Looking ahead, occupancy is expected to touch 70% in 2025, and ARR is projected to cross the ₹10,000 threshold by 2026. This continued growth will depend on policy reforms to accelerate hotel development cycles — currently averaging 42 to 60 months — and on unlocking financing through industry-level infrastructure status.

As the report warns, “This speed of development can become a barrier for the otherwise clear run for the sector to scale up.” Additionally, “Retaining and hiring fresh talent” has emerged as the top operational concern, cited by 28% of GMs.

Final Observations

India’s hospitality sector has entered a decisive phase — no longer simply recovering, but redefining its market structure. With a robust demand base, increasing investor participation, and strong macroeconomic fundamentals, the country is poised for long-term leadership on the global hospitality stage.

As HVS ANAROCK concludes, “India’s hospitality sector is no longer just growing — it’s gearing up to lead the world.”

The opportunity is vast, and the direction is clear. The challenge ahead is not growth, but managing that growth with discipline, innovation, and foresight.

Read more – Latest