Asia Pacific Hotel Construction Pipeline, Strong momentum drives Asia Pacific Hotel Construction Pipeline to new milestones in Q3 2025

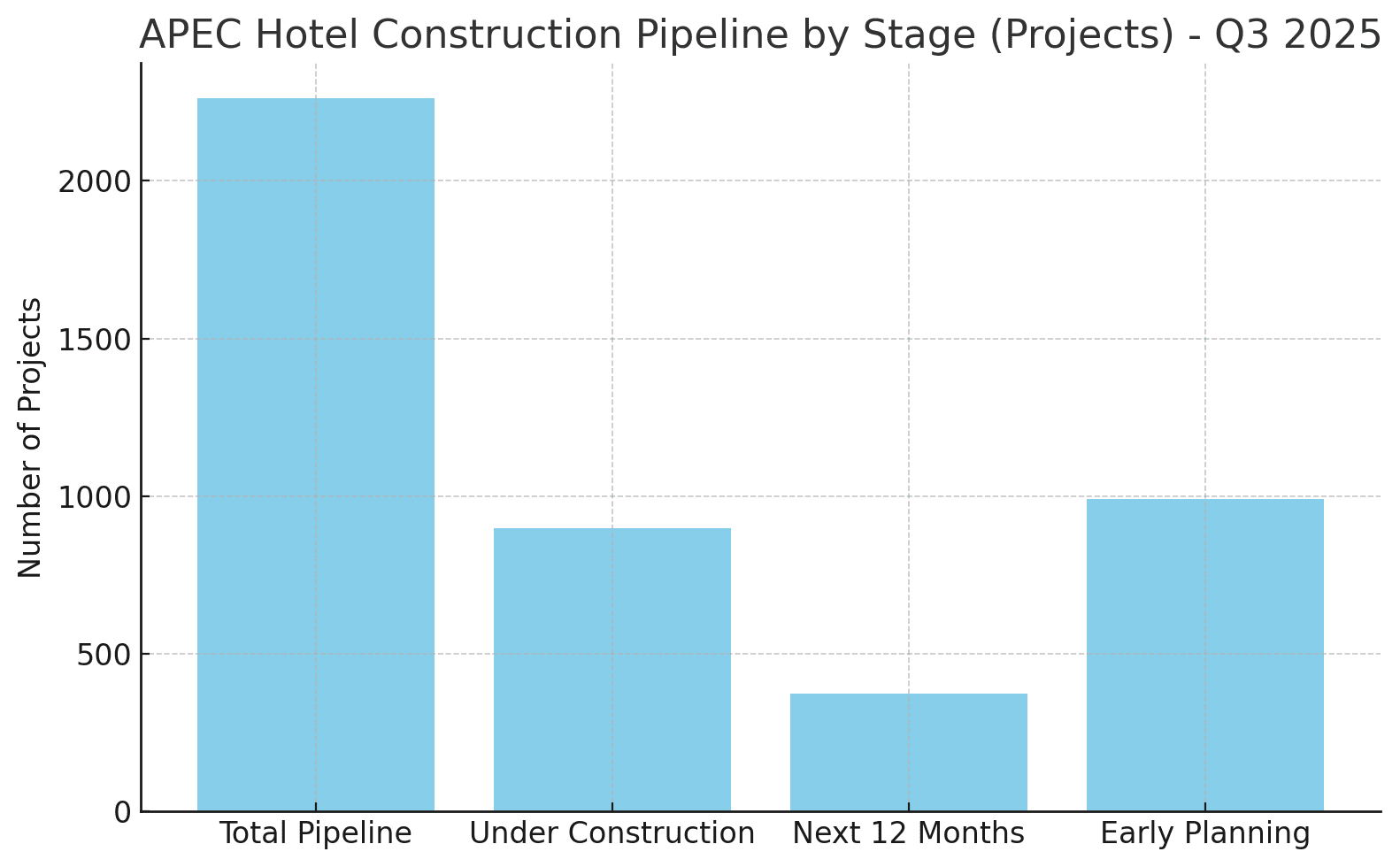

Lodging Econometrics (LE) has released its latest Hotel Construction Pipeline Trend Report, revealing that the hotel development pipeline across the Asia-Pacific region, excluding China (APEC), has reached record levels through the third quarter of 2025. The total APEC hotel construction pipeline now stands at 2,262 projects and 434,593 rooms, reflecting year-over-year growth of 9 percent in projects and 6 percent in rooms.

At the end of Q3 2025, hotels currently under construction numbered 898 projects with 199,865 rooms, marking an increase of 6 percent in project count and 1 percent in room count compared with last year. Projects scheduled to begin within the next 12 months reached 374 projects with 72,215 rooms, growing 6 percent and 12 percent, respectively. The early planning stage also set new records, with 990 projects comprising 162,513 rooms, up 14 percent by projects and 9 percent by rooms year over year.

During the third quarter alone, new project announcements totalled 226 projects with 42,405 rooms, while construction starts amounted to 102 projects with 24,430 rooms. Both categories nearly doubled compared with the same period last year, underlining the region’s strong investment momentum.

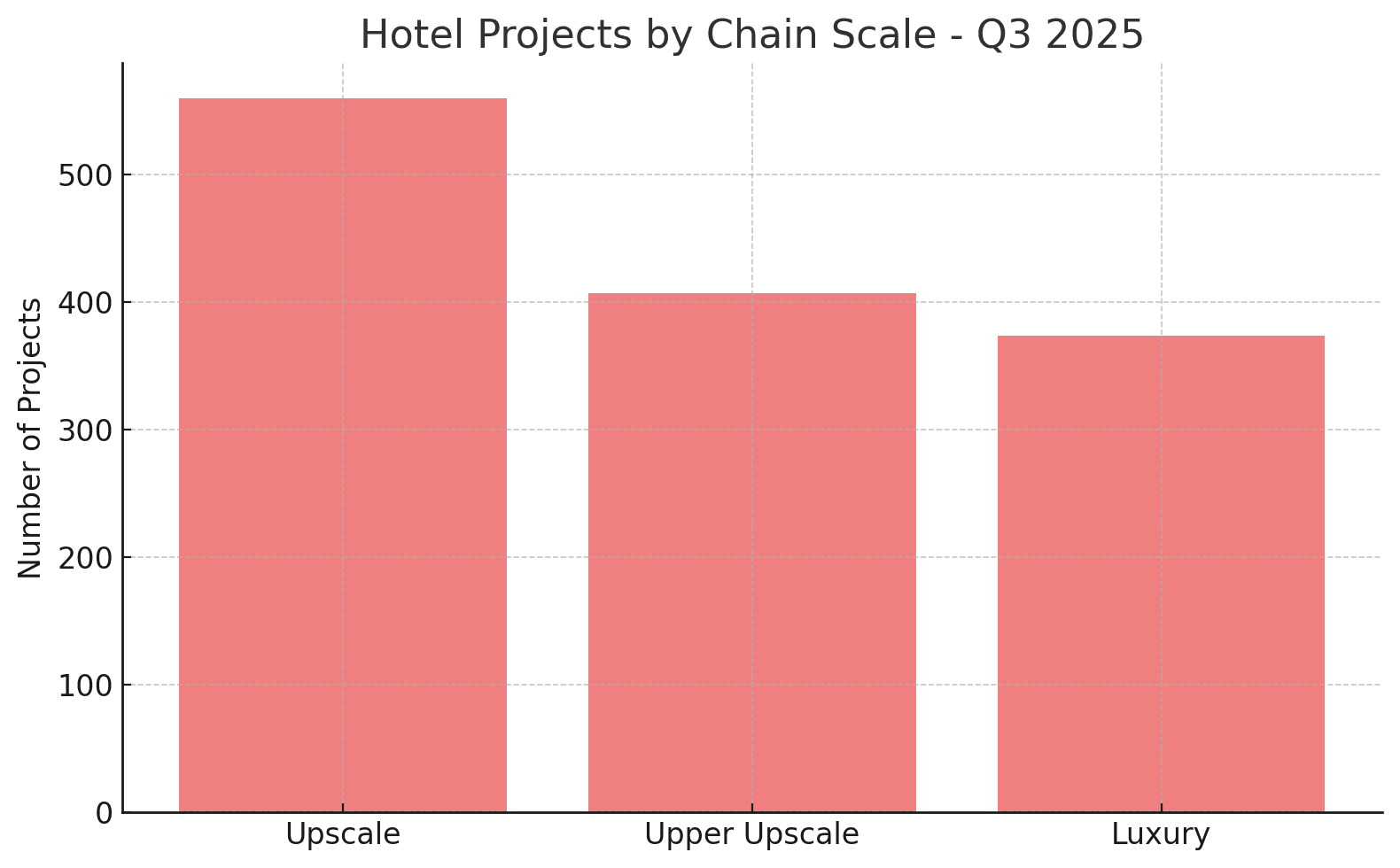

The upper upscale and upscale segments continue to dominate development in the region, accounting for 43 percent of projects and 45 percent of total rooms. The upscale category recorded an all-time high of 560 projects and 109,928 rooms, up 11 percent and 10 percent respectively. The upper upscale category also reached new highs, with 407 projects and 86,110 rooms, up 12 percent and 7 percent year over year. The luxury segment followed suit, closing the quarter at 374 projects and 70,470 rooms, reflecting 15 percent growth in projects and 12 percent in rooms.

Renovations and brand conversions across the region also reached unprecedented levels, totalling 287 projects and 52,825 rooms, an increase of 24 percent in project count and 7 percent in room count compared to the previous year.

India continues to lead hotel development in the APEC region, achieving record figures with 838 projects and 108,775 rooms at the end of Q3 2025, representing a rise of 31 percent in projects and 37 percent in rooms year over year. India now accounts for 37 percent of all projects and 25 percent of rooms in the regional pipeline. Other key markets include Vietnam with 248 projects and 91,003 rooms, Thailand with 167 projects and 43,600 rooms, Japan with 193 projects and 31,931 rooms, and Indonesia with 177 projects and 30,106 rooms.

The cities with the most active pipelines at the end of the third quarter were Bangkok, Thailand (65 projects/16,316 rooms), Jakarta, Indonesia (48 projects/10,466 rooms), Phuket, Thailand (42 projects/10,419 rooms), Bengaluru, India (39 projects/7,710 rooms), and Da Nang, Vietnam (24 projects/10,395 rooms).

Between January and September 2025, a total of 220 new hotels with 34,452 rooms opened across the APEC region. Lodging Econometrics projects that an additional 105 new hotels with 18,299 rooms will open before the end of the year, bringing the total for 2025 to 325 hotels with 52,751 rooms.

Looking ahead, the forecast anticipates continued growth with 336 new hotels comprising 72,886 rooms expected to open by the end of 2026, followed by 322 hotels with 58,100 rooms projected for completion by year-end 2027.

The report underscores the resilience and sustained expansion of the Asia-Pacific hospitality sector, driven by rising travel demand, expanding middle-class markets, and a robust appetite for investment in high-quality accommodation across the region.

Read More: News

1 Comment