Hotel Volatility Index: Established Hotels Set the Benchmark for Stability and Premium Hospitality Performance in India’s Evolving Hospitality Market

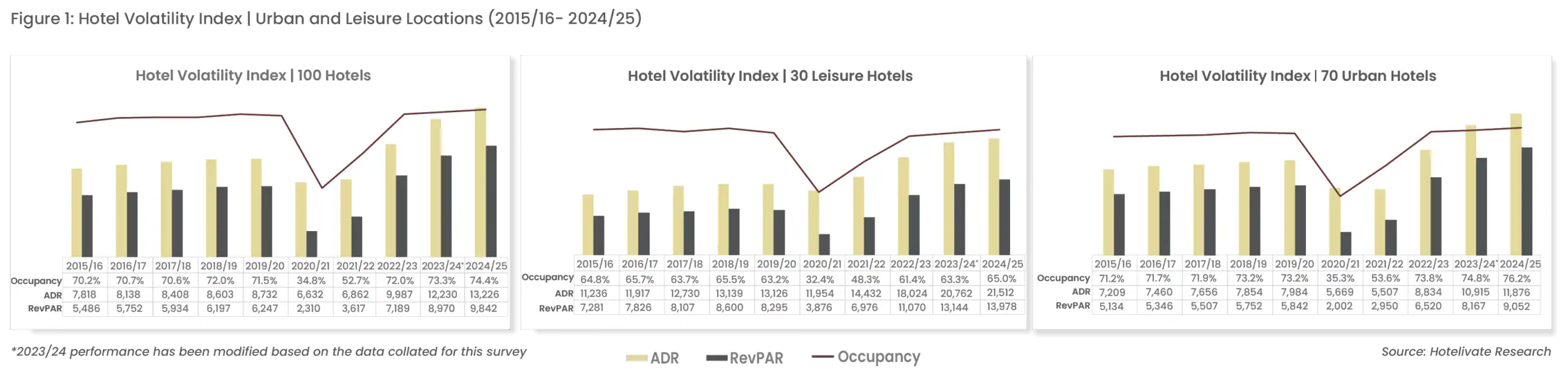

Recent analysis of India’s hotel market indicates that performance data can often be distorted by newly opened hotels that are yet to stabilise, affecting both occupancy and average room rates. This is particularly evident in fast-growing markets such as India. To address this and provide a more accurate assessment, a base of 100 hotels operational since 2012 or earlier was selected to create the Hotel Volatility Index (HVI), offering a balanced benchmark for year-over-year performance across the country.

Performance Overview 2015/16 to 2024/25

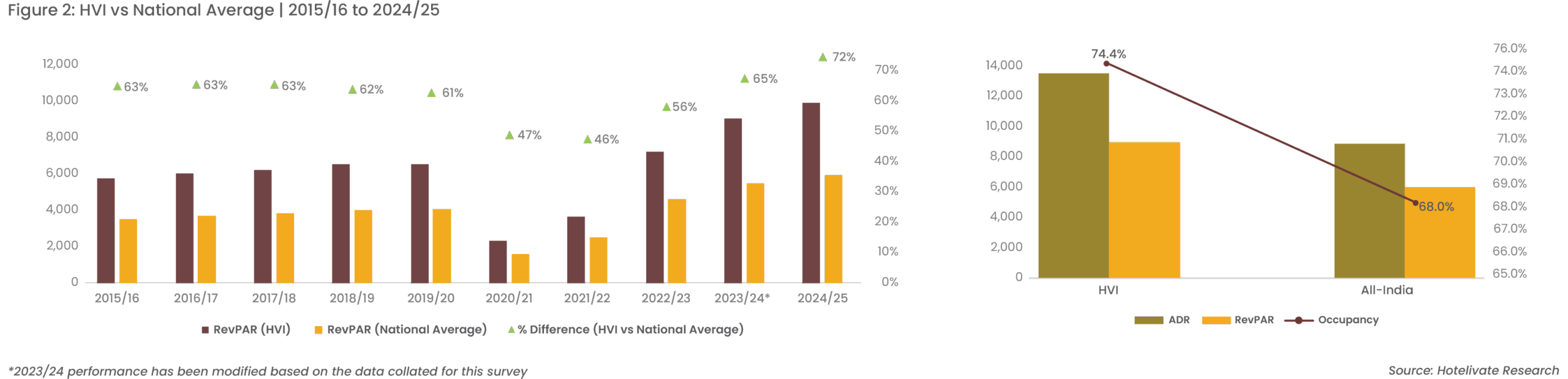

The HVI tracks occupancy, average daily rate (ADR), and revenue per available room (RevPAR) across these 100 hotels. In 2024/25, HVI hotels recorded exceptional performance, outperforming national averages by a considerable margin. They achieved an occupancy premium of 9.4 percent and an ADR premium of 56.9 percent, resulting in a RevPAR premium of 71.2 percent, the highest seen in recent years.

This strong showing reflects the positioning of HVI hotels, which are concentrated in mature, high-demand locations. In contrast, the national hotel supply now includes a growing number of properties in developing markets, naturally widening the performance gap. HVI hotels achieved an occupancy rate of 74.4 percent compared to the national average of 68 percent and an ADR of ₹13,226 compared to ₹8,432 for the overall market. These figures demonstrate the premium pricing power and demand stability that established hotels continue to enjoy.

Urban Versus Leisure Performance

A closer comparison between urban and leisure hotels reveals shifting dynamics. Urban hotels achieved an occupancy rate 11.2 percent higher than leisure hotels, yet leisure properties maintained a 54.4 percent RevPAR premium. However, the gap between the two segments is narrowing. In 2023/24, the difference stood at 60 percent, while in 2024/25 urban hotels recorded RevPAR growth of 10.8 percent year-on-year, compared to 6.3 percent for leisure hotels. This indicates a strong rebound in business and city travel and signals the continued revival of India’s urban hospitality sector.

Regional and Brand Insights

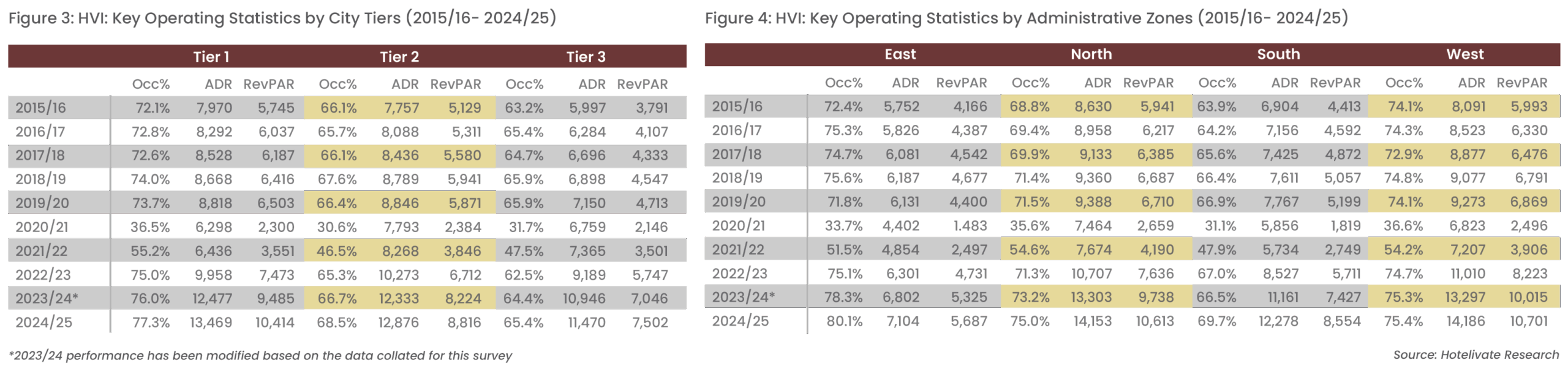

The analysis further explores variations in performance across city tiers, administrative zones, and brand origins. In each case, HVI hotels outperformed the broader market, reaffirming that long-established, strategically located assets demonstrate both stability and sustained profitability even in fluctuating market conditions.

A Measure of Resilience and Return

The HVI provides an objective benchmark for long-term performance assessment within India’s hotel industry. Mature properties have shown that resilience and patience yield significant rewards during recovery cycles. By using downturns to streamline operations, reinvest in renovations, and respond to evolving traveller expectations, these hotels have achieved record-breaking performance.

Industry experts emphasise that hotel owners should allow time for properties to stabilise fully before drawing conclusions on financial success. Continuous investment in upgrades, robust asset management, data-driven sales strategies, and talent development remains crucial to sustaining momentum. Looking ahead, HVI hotels are expected to maintain steady occupancy levels with moderate rate growth, further reinforcing the importance of strategic management in driving long-term profitability.

Read More: News