Q3 FY2026 marks IHCL’s fifteenth straight record quarter, driven by strong hotels, TajSATS, and New Businesses

The Indian Hotels Company Limited (IHCL) has reported its consolidated financials for the third quarter and nine months ending December 31st, 2025.

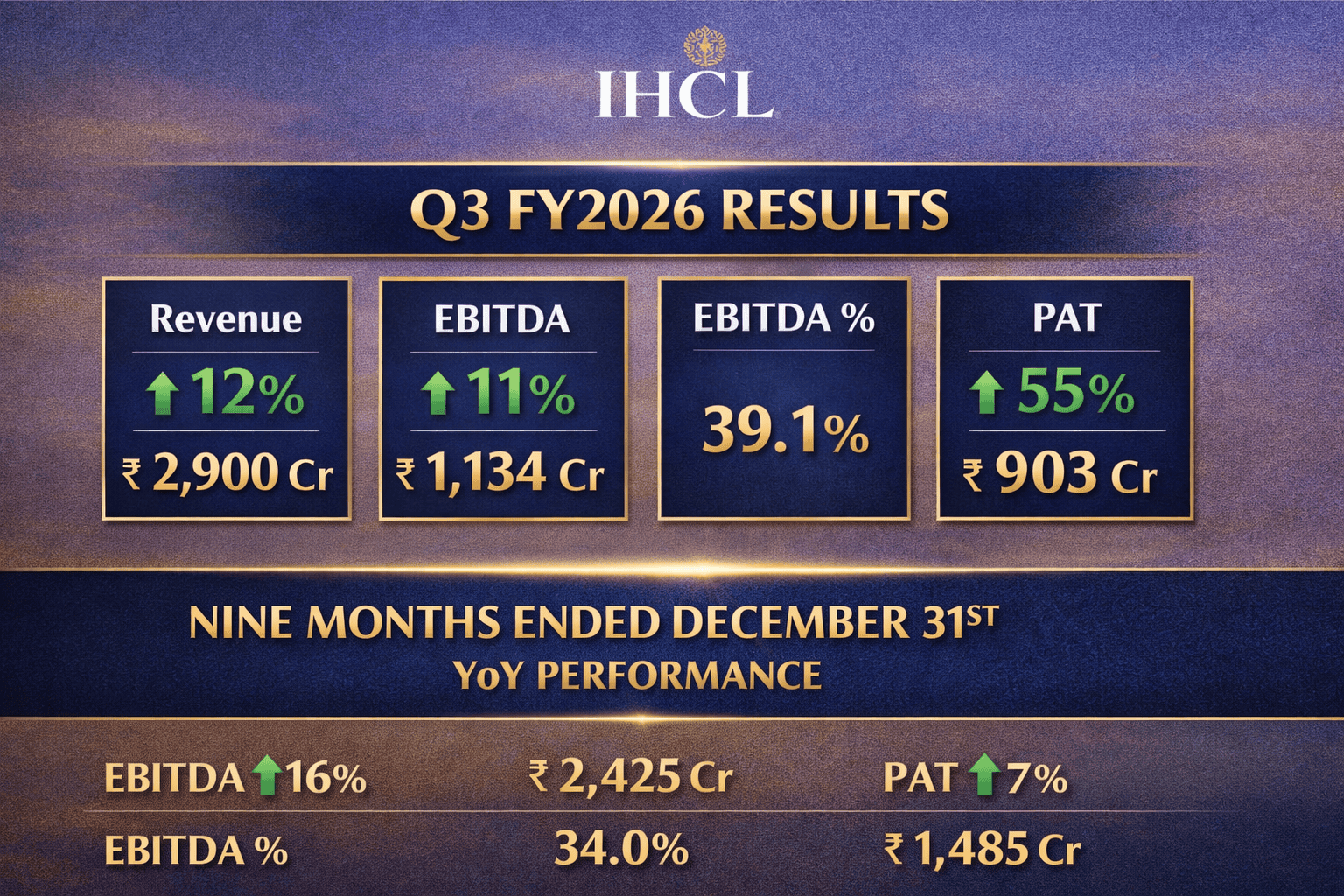

For Q3 FY2026, Revenue increased 12% to ₹ 2,900 Cr, while EBITDA grew 11% to ₹ 1,134 Cr, resulting in an EBITDA margin of 39.1%. PAT rose 55%* to ₹ 903 Cr. For the nine months ended December 31st, EBITDA increased 16% to ₹ 2,425 Cr with an EBITDA margin of 34.0%, and PAT grew 7% to ₹ 1,485 Cr. Revenue for the nine-month period recorded a 17% year-on-year growth.

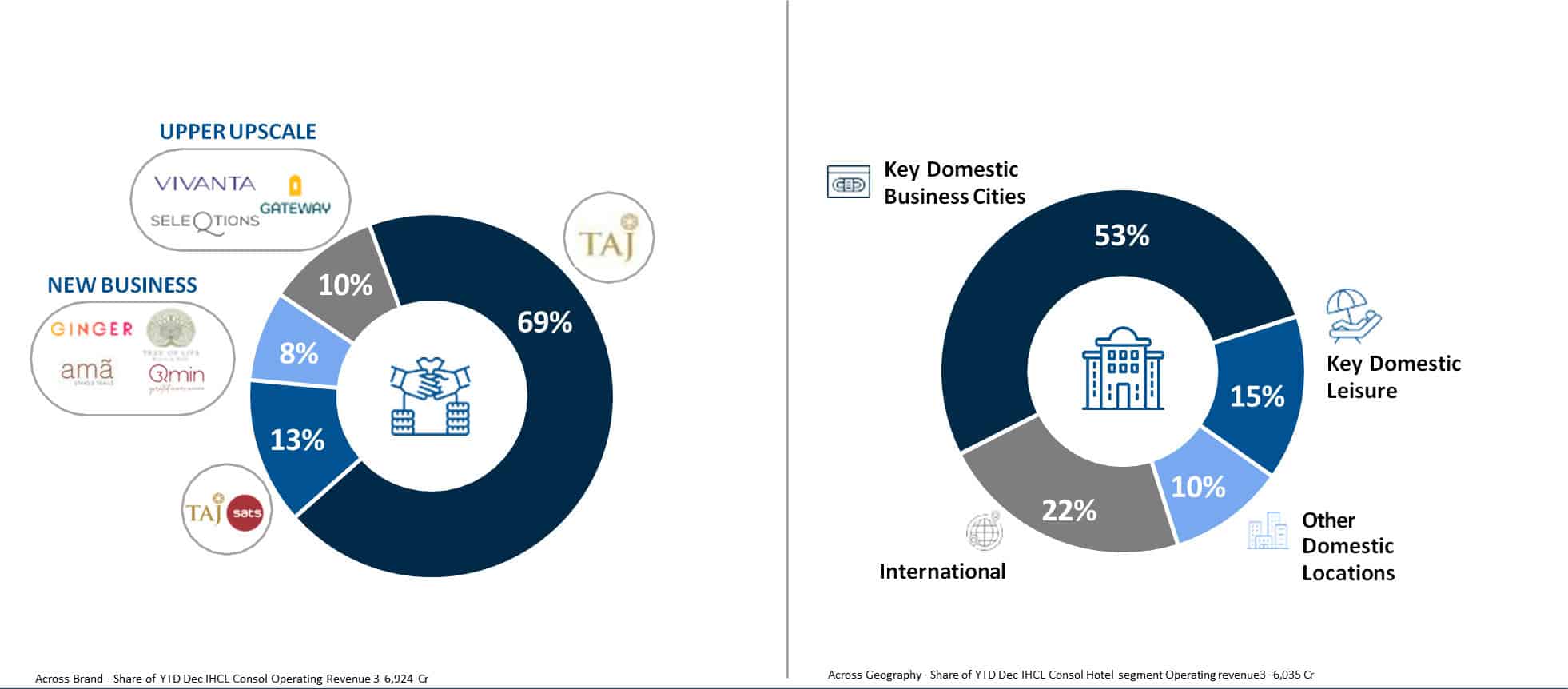

Puneet Chhatwal, Managing Director & CEO, IHCL, said, “Q3 FY2026 marks the fifteenth consecutive quarter of record performance with a Consolidated revenue of INR 2,900 crores, a 12% growth over the previous year, EBITDA of 1,134 crores and an EBITDA margin of 39.1%. The revenue in the quarter was driven by a strong same-store performance, not like-for-like growth, supported by a 17% growth in airline and institutional catering and 31% growth in New Businesses. The hotel segment reported a revenue of INR 2,579 crores, resulting in the best-ever quarterly EBITDA of INR 1,050 crores.”

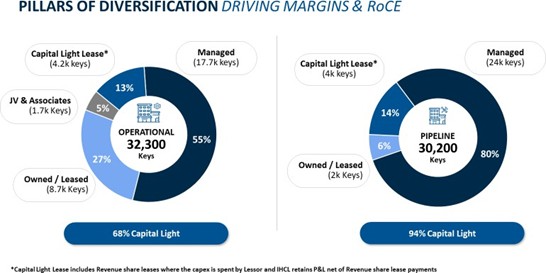

He added, “IHCL continued its growth momentum in FY2026 with 239 signings to reach a portfolio of 617 hotels and opened and onboarded 120 hotels, led by strategic partnerships and acquisitions. Under Accelerate 2030, IHCL expanded its brandscape with the acquisition of a controlling stake in Atmantan, an integrated wellness brand and entered into definitive agreements to acquire 51% stake in Brij, a boutique experiential leisure offering and scaled the Ginger brand with 51% acquisition in ANK & Pride Hospitality.”

Puneet Chhatwal also noted, “IHCL Consolidated continues to maintain a healthy balance sheet with a gross cash balance of INR 3,877 crores as on 31st December 2025. IHCL is well placed to deliver sustained performance enabled by a diversified topline across brands, geographies and contract types.”

Ankur Dalwani, Executive Vice President and Chief Financial Officer, IHCL said, “For Q3 FY2026, IHCL Standalone reported a revenue of INR 1,654 crores, clocking a strong EBITDA margin of 48.2%, an expansion of 40 basis points and a PAT of INR 921 crores post Exceptional Items.”

He added, “During the nine months ending December 2025, IHCL Consolidated generated cash of about INR 1,600 crores and undertook capital expenditure to the tune of INR 750 crores towards greenfield projects at Ekta Nagar, Taj Frankfurt, brownfield expansion at Taj Ganges Varanasi and the upcoming Taj Bandstand project along with renovations to key hotels such as Taj Palace Delhi, Taj Fort Aguada Goa, President Mumbai and St James Court London among others.”

FINANCIAL PERFORMANCE

Consolidated same-store hotels delivered a 9% RevPAR growth, while Management Fee income grew by 15% to INR 203 crores on the back of not like-for-like growth.

PORTFOLIO GROWTH YEAR TO DATE

IHCL signed 239 hotels across its brandscape, including entering into strategic acquisitions and partnerships with Clarks Group, Madison, Rajdarbar Group, Ambuja Neotia and Atmantan brand. IHCL opened and onboarded 120 hotels, taking operating hotels to 361 with an inventory of over 32,000 rooms.

NEW & REIMAGINED BUSINESSES

The Air & Institutional Catering business segment (TajSATS) clocked a revenue of INR 323 crores, reflecting a 17% growth over the previous year, with an EBITDA margin of 26%. New Businesses comprising of Ginger, Qmin, amã Stays & Trails and Tree of Life reported an Enterprise revenue of INR 316 crores, a growth of 39%, and Consolidated revenue of INR 215 crores, a growth of 31%. Enterprise Revenue of Ginger stood at INR 232 crores with a strong EBITDAR margin of 47%. Qmin has grown to 110 outlets across multiple formats, amã Stays & Trails has reached a portfolio of 351 bungalows with 176 in pipeline, and Tree of Life is at a 27-resort portfolio with 9 in pipeline.

Read more – News