India Tourism Sector, according to Capitalmind PMS’s new report, is picking up fast

More money in people’s pockets and better transport are leading to record trips within the country and more foreign visitors for luxury and cultural stays. India’s tourism and hospitality sector, while a key GDP driver, still trails global peers—2% below the US and 4% below Thailand in contribution to GDP. But here’s the exciting part: there’s massive room to grow. The sector is expected to generate over INR 5,12,356 crore (US$59 billion) by 2028, with Foreign Tourist Arrivals (FTAs) hitting 30.5 million, per the Ministry of Tourism Government of India.

Tourism’s Contribution

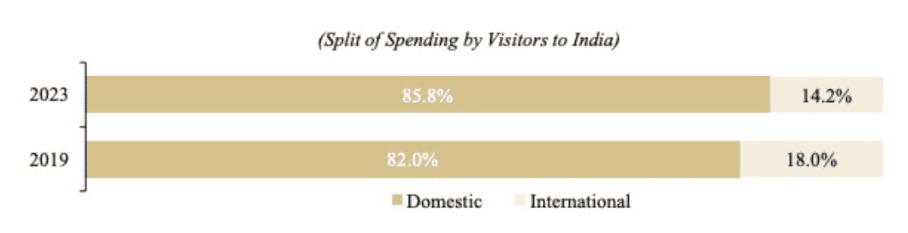

Domestic tourism in India is on fire, expected to double to 5.2 billion visits by 2030 from 2.5 billion in 2024 (13.4% CAGR). Domestic visitor spending grew from INR 12.74 trillion in 2019 to INR 14.64 trillion in 2023 and is projected to hit INR 33.95 trillion by 2034 (7.9% CAGR), per WTTC’s Economic Impact Research, 2024. Improved connectivity—air, road, and rail—plus tourism infrastructure investments are supercharging this growth. Domestic air passenger traffic is set to more than double to 693 million by FY30 from 307 million in FY24.

The travel market is set to soar from US$75 billion in FY20 to US$125 billion by FY27. Domestic tourism sector in India is the real MVP, with Domestic Tourist Visits (DTVs) jumping 44.98% from 1,731.01 million in 2022 to 2,509.63 million in 2023. Uttar Pradesh (478.53 million) and Tamil Nadu (286.01 million) led the pack, while Maharashtra (3.39 million) and Gujarat (2.81 million) topped foreign tourist visits. FTAs reached 18.89 million in 2023, surpassing the 2019 peak of 17.91 million by 5.47%. South Asia (29.02%), North America (21.82%), and Western Europe (20.40%) were the top sources, with leisure travel (46.2%), diaspora visits (26.9%), and business

travel (10.3%) driving arrivals. Foreign Tourists Are Back, But Smarter. Inbound tourism grew 64% YoY in 2023. But here’s the kicker— foreigners are now skipping Europe for India’s luxury wellness retreats. Ayurveda resorts, palace stays, yoga spas: all booked out. India’s value for luxury is slowly getting noticed.

India’s Economic Boom

As per IMF’s World Economic Outlook April 2025, India’s GDP grew by a robust 7.4% in 2024 and is set to climb 7.1% in 2025. From a US$3.6 trillion economy in 2022–23, it’s projected to hit US$5.1 trillion by 2026–27 and a whopping US$6.8 trillion by 2030. In 2023, India contributed 16% to global growth, per the WEF.

Per capita income is also on a tear, growing at a 5.4% CAGR from 2018 to 2024 to reach US$2,711. By 2030, it’s expected to hit US$4,469, clocking an 8.7% CAGR. Urbanization is another tailwind—40% of India’s population (about 518 million people in 2023, per the World Bank) will live in urban areas by 2036, up from 31% in 2011.

Growing affluence, an increase in high and upper middle-income households, a low median age of the population, and a rise in urbanization are expected to drive higher consumption, particularly in the luxury segment. Between FY21 and FY31, India’s incremental consumption potential is pegged at US$3 trillion—2.4 times higher than FY21 levels—with a 9% CAGR, making it a US$5 trillion consumption economy by 2031. Private Final Consumption Expenditure (PFCE) rose 7.2% to INR 106 lakh crore from INR 99 lakh crore, while CPI has been dropping for nine straight months. Translation? More money in pockets, ready to be spent on experiences like travel and hospitality.

Aviation: Taking Flight

India’s aviation sector is soaring and is the third-largest domestic aviation market globally. It is on track to be the third-largest overall by 2026, per IATA. From 50 operational airports in 2000, India now has 148, aiming for 220 by 2027.

Scheduled flights jumped 77.7% over the past decade to 1.3 million in 2024 (6.9% YoY growth), with domestic flights rising from 613,000 in 2014 to 1.1 million in 2024. IndiGo dominates with a 53% share of departing flights. Despite this, India accounts for just 4.2% of global aviation, signaling massive growth potential.

Hospitality Landscape (Supply and Demand): Scarcity

India’s hospitality industry boasts 3.4 million keys as of March 31, 2024, but the organized sector (branded, aggregators, quality independents) is just 11% (375,000 keys). Branded hotels make up 45% of this (170,000 keys), with luxury hotels a mere 17% (29,000 keys across 230 hotels). The sector operates through owner, manager, and franchiser models, with owner-manager setups optimizing profitability and brand growth.

The demand-supply gap, especially in luxury, is widening due to rising incomes, premium preferences, and limited inventory. Barriers like scarce land, high capital costs, and long gestation periods keep supply constrained, driving ARR growth and occupancy (60–70% in luxury). The luxury segment’s Total Revenue per Available Room (TRevPAR) is 117% higher than upscale and 298% higher than midscale.

Weddings, MICE, and F&B: The Party Never Stops

Food and Beverage (F&B) is a cash cow for hotels, with luxury segment F&B revenue per occupied room 1.9 times the industry average in 2023. Weddings and MICE (Meetings, Incentives, Conferences, Exhibitions) are major growth drivers. The Confederation of All India Traders (CAIT) reported 3.8 million weddings between November 23 and December 15, 2023, generating INR 4.74 lakh crore (26% YoY growth).

India’s 600 million-strong 18–35 age group, the world’s largest millennial and GenZ cohort, drives this surge, fueled by rising incomes and changing consumption patterns. India hosts around 10 million weddings annually. The Indian wedding industry ranks second globally. According to a report published by the Economist, the wedding industry is the fourth-largest industry in India, recording a huge spending of US$ 130 billion per year.

High Net Worth Individuals (HNWIs) are set to grow 107% to 1.65 million by FY27, and Ultra HNWIs (net worth ≥US$30 million) will rise 50.1% from 13,263 in 2023 to 19,908 in 2028, per Knight Frank’s The Wealth Report 2023 & 2024. Destination weddings in Jaipur, Udaipur, Goa, and Delhi are booming, with buyouts and large-format weddings generating INR 25–30 million (US$300,000–360,000) per event for luxury hotels. Hotel expenses account for 50% of destination wedding spend.

Corporate Travel: The Office Boom

India’s office sector is buzzing, with 2024 gross leasing volume (GLV) hitting a record 89 million square feet (MSF) across eight cities, up 19% from 2023, per Cushman & Wakefield. Bengaluru led with 25.93 MSF (29%), followed by Mumbai (17.84 MSF, 20%) and Delhi-NCR (13.14 MSF, 15%). Net absorption reached 50 MSF, surpassing 2019’s pre-COVID peak by 7 MSF. Global Capability Centers (GCCs) drove 27% of this growth, with 1,700 GCCs employing 1.9 million in FY24, projected to hit 2,100–2,200 by 2030 with export revenues of US$99–105 billion. This office boom fuels corporate travel, boosting demand for business hotels and business retreats, especially in tech hubs like Bengaluru and Hyderabad.

India’s hospitality and tourism sector is on the cusp of a remarkable transformation, and it’s hard not to be optimistic about its trajectory. Fueled by a rapidly growing economy, increasing disposable incomes, and a young, urban population eager to travel, the industry is gaining momentum. By streamlining visa processes, improving infrastructure, and balancing affordability with premium offerings, India’s hospitality industry has the potential to establish itself as a global leader in tourism.

Read more: News