India’s wedding industry is not merely a cultural institution. It is one of the country’s most formidable economic engines.

On a winter evening in Udaipur, as the sun lowers behind the Aravalli hills, a palace courtyard glows in muted gold. Diyas shimmer against carved sandstone. Lake Pichola mirrors a mandap rising in silk and antique florals. Guests are not arriving for a single ceremony. They are entering a three-day narrative.

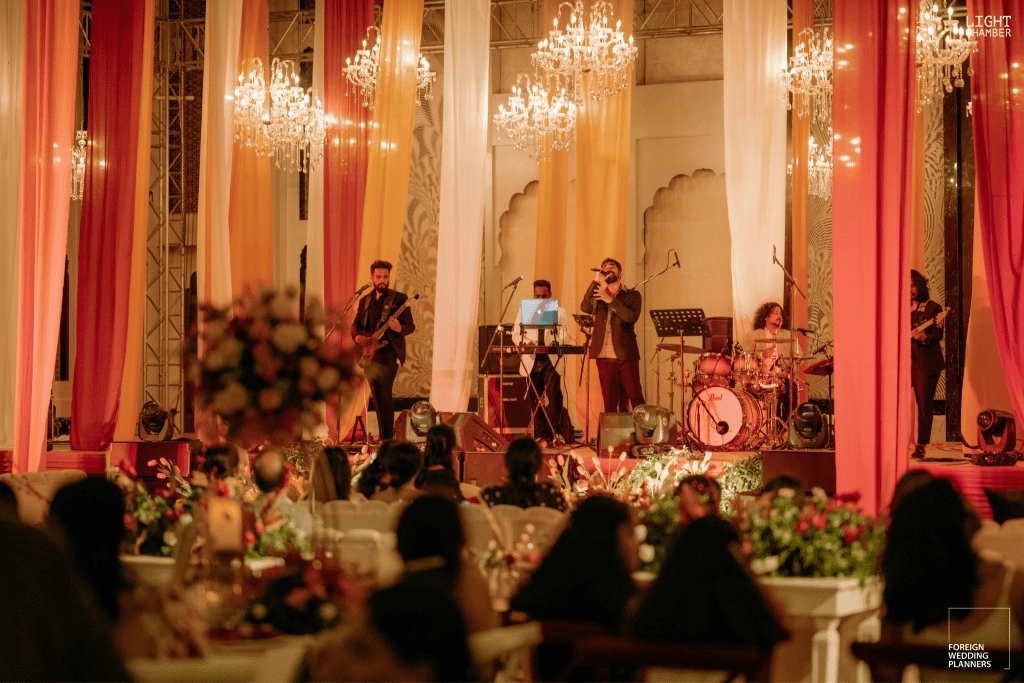

And that narrative could well be Tomorrowland! Translating dreams into reality are India’s wedding planners who give you reality bytes that frame the big picture. Shares Ekta Saigal Lulla, Founder, ESL Events, ” We’ve worked with clients who were passionate about board games and transformed their celebration into a full-fledged board game-themed wedding, complete with interactive game stations and design elements inspired by their favourites. Another client’s love for Tomorrowland led us to curate an immersive music festival-style experience, complete with neon lighting, eclectic stage setups, and electrifying live performances that transported guests into a world of rhythm and revelry.”

And so the wedding story unfolds … a welcome dinner overlooking the lake. A curated heritage walk through the old city. A sunrise mehndi framed in handwoven drapes sourced from Varanasi. A reception that blends classical ragas with contemporary orchestration.

Two hundred guests have flown in across four continents. The hotel is fully booked for four nights. Florists collaborate with local artisans. A Mumbai atelier has worked for months on a handloom bridal ensemble inspired by ancestral textiles. Jewellery commissioned in Jaipur draws upon temple craftsmanship. Taxi operators, lighting technicians, caterers, priests and production teams operate in synchronised precision.

It appears intimate. It functions as an economic engine. Reveals Vikramjeet Sharma, Founder of Le Florence Weddings, “Imagine a wedding where the décor is inspired by Parisian elegance, with a touch of Moroccan mystique, or where the entertainment includes dancers from Africa, Europe, and even artists flown in from South America. Themes like Moulin Rouge, black-and-white galas, or even a whimsical fairy tale setting are just the tip of the iceberg.”

One celebration moves crores across sectors. It fills hotel inventory in what was once a shoulder week. It fuels aviation demand. It activates artisan supply chains. It generates global social visibility that no tourism campaign can purchase outright.

Three months later, in Dubai, a ballroom overlooking the Creek transforms overnight into a mandap suspended in light. The skyline shimmers as 600 guests gather for a sangeet choreographed with cinematic precision. Charter flights land from Mumbai and London within hours. Luxury coaches ferry guests between a desert welcome dinner and a yacht-hosted after-party.

A five-star property allocates entire floors for family occupancy. Private chefs are flown in. Jewellery worth crores travels under secured logistics. A digital command centre manages live streaming for relatives in Toronto and Singapore. Four days unfold. The economic ripple continues far longer. Hotels benefit. Airlines benefit. Destination management companies benefit. Florists, stylists, transport operators and audiovisual specialists benefit.

Says noted wedding planner, Birju C Gariba, Founder and CEO, Iskra Events, “Big arrivals will continue to trend on social media and will see the use of SFX ( Special Effects) to the next level, blended with dancers in exotic costumes as well as props that are inspired by Bollywood. Baraats, which are the traditional domain of grooms, have seen a parallel in bridal Baraats as well, and these may become the next big thing.”

Agrees Kaveri Vij, Co-Founder, Designer Events, “Grand entrances will reach new heights, featuring horse-drawn carriages, choreographed dances, and even hot air balloons.”

The imagery travels globally, reinforcing destination branding. Multiply those two scenes by nearly ten million weddings annually. That is the scale of India’s wedding economy.

The ₹5 Lakh Crore Architecture

India hosts close to 10 million weddings every year. The wedding industry is valued at approximately ₹5 lakh crore and growing at an estimated 20–25 per cent annually. An average urban wedding ranges between ₹15 lakh and ₹50 lakh. Destination weddings frequently exceed ₹1 crore. Ultra-luxury celebrations can cross ₹50 crore.

Shares Vikramjeet Sharma, “The planning for these grand Indian weddings usually kicks off about a year in advance, and believe me, it’s worth every moment. Setting up the venue can take days—sometimes weeks—but it’s all part of the process.”

Spending patterns reveal the scale of this influence. Venues and catering typically absorb 35–40% of overall budgets. Hospitality has emerged as the most strategically transformative category. Weddings have moved from banquet department revenue to boardroom priority.

Spending distribution broadly reflects jewellery as the largest category, followed by venue and hospitality, couture, décor, catering and entertainment. Jewellery alone accounts for nearly one-third of expenditure, reinforcing India’s position as one of the world’s largest gold markets. while jewellery and wedding attire account for another 25–30%. Gold purchases worth nearly ₹3.5 lakh crore each year see a majority demand linked directly to marriage ceremonies. Bridal ensembles span a remarkable range, starting at ₹50,000 and reaching ₹50 lakh or more, reflecting both aspiration and status.

Meanwhile, cinematic wedding films and premium photography packages, priced between ₹3–15 lakh, have emerged as lucrative specialised segments. Financing trends further underline the emotional weight of the occasion, with around one-third of families opting for loans averaging ₹8–12 lakh. Projections suggest the industry could approach ₹15 lakh crore by 2028.

Remarks leading wedding planner, Mareesha Parikh, Director of Swaaha Weddings & Experiences and CEO of Nautanki Company, “Mythological themes are set to take centre stage—grand, cinematic storytelling inspired by ancient Indian epics, blended with modern theatrics, music, and lighting. But personal storytelling will always remain a classic, couples love weaving their own journeys into the celebrations, making each moment unforgettable.”

In India, a wedding is no longer a social ritual; it is a powerful economic force woven deeply into culture, tradition and national growth.

Destination India: The Expanding Domestic Circuit

Rajasthan remains the benchmark. Udaipur’s lakeside palaces, Jaipur’s fort courtyards and Jodhpur’s desert heritage properties anchor large-format celebrations. Goa balances beach romance with accessibility. Kerala’s backwaters deliver understated elegance. Manali, Rishikesh, Tehri, Jim Corbett and Shimla are witnessing a surge in mountain weddings driven by cooler climates and intimate guest lists. Mahabalipuram, Chettinad mansions and Hampi offer architectural gravitas. Nashik vineyards are increasingly preferred for experiential ceremonies. The Andaman & Nicobar Islands and Lakshadweep are emerging alternatives for island luxury.

India’s wedding geography is expanding beyond traditional hubs into layered, experience-led destinations.

The Global Footprint

Indian weddings remain culturally rooted, yet increasingly staged across destinations that can execute scale. Thailand continues to lead international formats, with Phuket and Krabi favoured for resort density, beach settings, and suppliers accustomed to Indian ceremonies and multi-day programming.

The UAE stays strong for large diaspora-led celebrations because Dubai and Abu Dhabi combine fast air connectivity, deep luxury inventory, and venues designed for high-guest-count production. Industry reporting also shows newer Gulf contenders pushing into this space. Oman, for instance, has explicitly targeted India’s luxury planners and wedding specialists via focused trade programmes, signalling a clear intent to compete for destination celebrations.

At the ultra-high-net-worth end, Italy, especially Lake Como and Tuscany, remains a statement choice where private villas and heritage settings match the appetite for exclusivity and cinematic staging. Bodrum, Santorini and Bali remain aspirational because they deliver instant visual identity plus mature hospitality ecosystems.

Says Mareesha Parikh, ” Personally, I’m excited about the unexplored gems—hidden treasures in Oman and lesser-known spots in Turkey, Azerbaijan, Georgia, and Eastern Europe. These destinations bring something fresh to the table, giving couples a chance to create unique and unforgettable wedding experiences.”

What is changing is how families shortlist: visa ease, direct flight or charter feasibility, and dependable production infrastructure now sit alongside romance and scenery.

2026 Wedding Trends

In 2026, weddings are becoming more personal and experience-led. Couples are planning smaller, well-managed celebrations with a strong focus on guest comfort and good flow across events. Décor is cleaner and more thoughtful, with statement flowers, warm lighting, and locally inspired touches. Fashion is more individual, with modern takes on traditional wear and coordinated looks for families. Food is also getting more exciting, with regional menus, live counters, and custom cocktails. Sustainability is now part of the plan, seen in mindful gifting, less waste, and support for local artisans.

Venues: Experience Over Excess

Boutique heritage properties are increasingly preferred over oversized ballrooms. Outdoor mandaps set against lakes, vineyards and desert dunes dominate visual storytelling. Multi-day itineraries now include curated city walks, local craft interactions and wellness mornings. Sustainability enters negotiation conversations. Solar-powered resorts and biodegradable décor are influencing venue choice. Luxury is becoming atmospheric rather than overwhelming.

Mood and Aesthetic

The palette of 2026 is archival. Antique ivory, muted gold, sage green and dusty rose replace loud saturation. Décor references regional heritage: Pichwai art, temple motifs, Banarasi textiles and Chettinad columns return in refined forms. Minimalist mandaps allow architectural context to breathe.

Couture

In 2026, bridal couture is leaning into handloom as the new sign of luxury, not as a nostalgia cue but as a statement of craft and good taste. Banarasi, Paithani, and Kanjeevaram silks are returning in refreshed ways, woven lighter, draped softer, and tailored into silhouettes that feel contemporary rather than ceremonial. Designers are cutting down bulk and building outfits that breathe, with cleaner structures, gentler linings, and smarter blouse engineering so brides can move, sit through rituals, and dance without feeling weighed down.

This shift is also changing how trousseaux are planned. Instead of one outfit per function, many brides are choosing convertible ensembles that can transform across events. A base sari or lehenga may gain an overskirt, lose a dupatta, pick up a cape, or switch styling to look entirely different for the evening. The look stays luxe, but the wardrobe becomes practical.

Grooms, too, are stepping beyond the single sherwani template. Layered styling is trending, with bandhgalas, achkans, shawls, and textured jackets bringing depth without loudness. Heritage details, subtle handwork, and thoughtful accessories are doing more of the talking, creating a modern, polished profile that still feels rooted. Overall, 2026 wedding fashion is about the craft you can feel and the comfort you can live in, with handloom at the heart of it.

Jewellery

In 2026, bridal jewellery is being chosen with two goals in mind: high-impact tradition for the wedding, and smart wearability for everything that comes after. Polki and uncut diamond styles still lead the bridal mood because they carry that old-world grandeur and photograph beautifully, especially with Indian silhouettes and ornate craftsmanship. They feel timeless without looking dated, which is exactly why families keep returning to them.

Shares Neha Mehrotra, Founder, Foreign Wedding Planners, “Convertible jewellery, such as detachable necklaces that transform into bracelets, will allow brides to get multiple looks from a single piece. Minimalist designs inspired by vintage aesthetics will blend the best of modern and traditional styles, featuring sleek lines with heirloom-inspired details.”

Temple jewellery has also moved beyond regional boundaries and is now a pan-India favourite. Brides across the country are embracing its bold motifs, antique finishes, and goddess-inspired forms, using it for ceremonies that lean traditional and pairing it confidently with modern drapes, softer styling, and even minimalist makeup. What was once seen as strongly South Indian now sits comfortably in wedding wardrobes across North, West, and East India, too.

Colour is another big story in 2026. Coloured gemstones are being used more thoughtfully, not as a loud contrast but as a way to echo the gentler tones showing up in couture. Emerald greens, ruby reds, and soft pinks are being matched with pastels, ivories, muted golds, and champagne shades, giving the overall look warmth and depth without overwhelming the outfit.

Younger buyers are also changing the market with clearer values. Lab-grown diamonds are gaining momentum because they align with ethical sourcing concerns and allow couples to choose larger, cleaner designs at more accessible budgets. For many, it is less about “status” and more about the story behind what they wear.

Above all, jewellery in 2026 is being evaluated as a long-term investment in style. Brides are asking what can be reworn, reworked, and reinvented: necklaces that can be layered, earrings that can shift between day and night, and sets that can break into smaller pieces for later use. The most loved purchases are the ones that do not end their life in a locker after the wedding, but keep returning in new versions, year after year.

Technology and Craft

Wedding-tech platforms streamline guest management and vendor logistics. Hybrid participation remains relevant for global families. Meanwhile, artisan clusters in Rajasthan, Varanasi, Kanchipuram and Kutch experience seasonal uplift through wedding demand. The wedding industry bridges luxury consumption and grassroots livelihood.

Sustainability and Responsibility

Environmental consciousness shapes 2026 decisions. Couples opt for biodegradable décor, plant-based menus and recyclable installations, outdoor destinations that reflect the mood of celebration. Luxury is increasingly defined by thoughtfulness. Neha Mehrotra, concurs, “Sustainability is also at the heart of Gen Z wedding trends. Eco-conscious choices such as thrifted wedding décor, locally sourced flowers, and ethical bridal fashion are becoming the norm. From biodegradable confetti to digital invitations and zero-waste receptions, couples are making conscious efforts to minimise their environmental footprint. Personalisation is key, with couples writing their own wedding vows, designing interactive digital invites, and even experimenting with 3D-printed wedding cakes to add a unique touch to their special day.”

The Strategic Outlook: An economic narrative wrapped in celebration.

The ₹5 lakh crore wedding industry influences hotel investment, aviation route planning, couture retail cycles and tourism board positioning. Few sectors generate such concentrated economic momentum across metropolitan and Tier-2 destinations. The Indian wedding of 2026 will be smaller in guest count yet higher in experience. Softer in aesthetic yet stronger in heritage storytelling. Digitally amplified yet emotionally intimate.

Indian weddings have evolved as a tourism accelerator. A cultural export. A luxury growth engine. The wedding economy stands at the intersection of all of it. It carries tradition forward while driving contemporary growth. It activates heritage properties and modern ballrooms alike. It uplifts artisans and luxury brands in equal measure. It connects India to the world through celebration.

And as the Indian wedding continues to travel across palaces and skylines, across continents and cultures, it reminds us of something fundamental. Celebration has always been part of India’s story. Today, it is also shaping its economic future.

Read More: Latest