Horwath HTL, in association with CoStar, hosted an exclusive industry evening titled “The Future is Ours – Bhavishyam Asmakam Asti” at The Ballroom, Taj Lands End, Mumbai and released the India Hotel Market Review 2025

The theme of the evening centred on India’s hospitality future—its growth trajectory, strategic balance and global relevance—bringing together senior leaders from hospitality, finance, investment and media to reflect on the sector’s present momentum and future direction.

The evening opened with “Vigour & Balance,” presented by Vijay Thacker, MD, Horwath HTL, and Partner & CEO, Crowe Advisory India LLP, who outlined the importance of strategic equilibrium in navigating growth, resilience and long-term value creation within an evolving hospitality landscape.

This was followed by a Regional Update by Karan Mahesh, Senior Sales Manager – South & Southeast Asia, CoStar, who shared data-driven insights into market performance, regional trends and demand patterns shaping the Indian hospitality market.

Brand strategy and scale were addressed in “ALL & More,” led by Ranju Alex, Chief Executive Officer, Accor, South Asia, who highlighted brand evolution, loyalty ecosystems and Accor’s strategic focus on India as a key growth market within its global portfolio.

Adding a macroeconomic lens, “An Economist’s Perspective” was delivered by Sameer Narang, Chief Economist at ICICI Bank. His session connected broader economic indicators, consumer sentiment and investment flows with hospitality demand and the sector’s outlook.

Luxury experiential travel took centre stage during “Tents and Villas,” featuring Vishnu Patel, Chairman of the Board, Praveg and Dhimaan Shah, Founder, Isprava & Lohono, moderated by Natasha Mehta, Vice President, Guest Services, The Oberoi Group.

The discussion explored the rise of alternative accommodation formats, destination-led luxury and the growing preference for bespoke, immersive stays.

The highlight of the evening was the panel discussion “Indian Hospitality – Core Values, World Values,” featuring Puneet Chhatwal, MD & CEO, IHCL and Aashish Aggarwal, Country Head, Jefferies India, with Mangalam Maloo, Deputy Editor, CNBC-TV18 as the chat host. The conversation focused on how Indian hospitality brands are aligning legacy values with global benchmarks, capital market expectations and international expansion ambitions.

The evening concluded with cocktails and dinner, offering attendees an opportunity to network and exchange perspectives in an informal setting.

Held at The Ballroom, Taj Lands End, Mumbai, the event drew a distinguished audience of industry stakeholders and reaffirmed the role of thoughtful dialogue, data-backed insights and collaborative leadership in shaping the future of Indian hospitality.

With performance data sourced from CoStar, Horwath HTL has added supply data, contributed market insights and analysed the opportunities and challenges for owners, investors, developers and operators.

The Future is Ours – Bhavishyam Asmakam Asti

Robust, but less hearty than could have been. Green, upward arrows on all key benchmarks. The substance and aroma of growth continue to prosper. Amidst quite some turmoil globally, the fabric of continued growth gives immense satisfaction, even a sense of pride. Amidst this positivity, lessons were learnt by the discerning.

In that sense, 2025 was qualitatively more relevant to the quantitatively strong preceding two years. Growth and buoyancy were tempered by external events and market realities – with strong underlying messages of the need to build resilience, of the value of diversified portfolios and of the importance of agility combined with sure-footed strategy and revenue play. The relevance of strategic value creation, as a de-risking element, was emphasised.

What worked: Widening demand, newer markets, GCCs and data centres, rate confidence, demand-supply imbalance, return to WFO, revenue (but not profit) benefit of GST changes, enhanced road infrastructure. Growth potential remains very positive in an undersupplied market. Importantly, the sentiment remains positive.

What didn’t work: Several external events impacted 2025. Maha Kumbh, Op Sindoor, West Asia crises, harsh weather and FDTL by Indigo. Foreign Tourist Arrivals remain slow. The Maha Kumbh took travel away from leisure markets, as everybody focused on the Kumbh. Even business travel took a hit. Only if Prayagraj had a material chain-affiliated supply, then 2025 would have been a stellar year – such was the vast turnout. And it brings to the forefront the value of tent accommodation and flexible seasonal supply.

Op Sindoor was a national necessity. Cancelled group events, which are a core demand segment in the summer, are not always easy to piece together for later in the year. The demand loss was for a shorter period in some markets, longer in Rajasthan and Punjab.

The West Asia crisis cut cross-border and long-haul travel; this affected Kerala and even some cities that rely upon Middle Eastern custom through the monsoons. The harsh weather is scary, unpredictable and ferocious in severity. Unforgiving, really, for what we are doing to nature. The hills lost business; the plains suffered from flash floods; Rajasthan (a desert state) had flood disruptions; the ghats of Varanasi were underwater. FDTL by Indigo was a negative outcome of supply concentration. It hurt many, including hotels and resorts, during prime time.

GST reduction from 12% to 5% for room rates upto ₹7,500 reads like a dream. But the simultaneously withdrawal of Input Tax Credit benefits for such hotels delivers a hurtful punch to the bottom line. Customers are happy; hotel chains are happy with higher fees from a heftier topline, but owners and revenue share models are hurting.

These impact factors strongly underline the exposure of the sector to external circumstances, to a degree that is possibly unique to the hotel sector. In turn, this stresses the values of and need for structural and financial balance, mature expansion strategies and leadership capacity. We must remain conscious that the ground can slip quickly, as we saw in Goa.

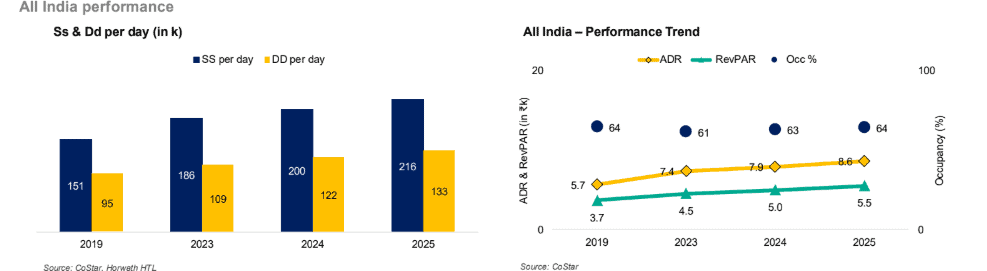

A significant quantitative positive was the addition of over 15k chain-affiliated rooms, among the largest annual growth to date. Demand grew 9.6% to 133k rooms per day. If one ignores the deflags, then 19k rooms were added this year.

Public ownership in the sector widened as ITC Hotels, Brigade Hotels and Leela Hotels were listed. 45% of chain-affiliated inventory is now under India-listed company ownership management, including 22% owned by these companies.

Sector consolidation has gained momentum over the last 2 years – acquisitions by IHCL across different segments, boutique hotels & wellness; strategic investment and marketing deal between Marriott & Fern, consolidation plan from Accor and Interglobe Hotels, asset consolidations at Juniper Hotels and Ventive Hotels and a couple of master franchises.

Revenue growth creates different landmarks. One hotel crossed ₹8 billion in revenue; two others crossed ₹5 billion, with two more on course to this threshold. The economic value of size cannot be overemphasised.

Leisure continues its upward path, also seeking new destinations. The surge of travel to game parks is positive; but it’s a leisure trip in essence with game viewing being a prime activity but not the prime motivation. The precaution needed is to balance supply with carrying capacity and not demand. Numbers will arise easily in a large nation with travel thirst, but nature must be the key bellwether in allowing new Ss.

Events & sports continue as growing demand drivers and need to be nurtured. The shift of Sunburn tanned Goa’s hotels. Ahmedabad gains from Motera; Mumbai from Jio Convention Centre & 3 cricket grounds. Goa, BLR & Chennai need a convention centre.

Opportunities:

Trade Deals – positive impact on manufacturing, services and inbound business travel

Wellness – a massive need, as a specialised product and not just an upgraded spa. Chain participation can deepen the segment, but only if wellness concepts (and not brand/loyalty program straight lines) are allowed to lead.

Weekend getaways – key for most business cities, but scant in offer and consistency. ADR growth opportunity from lesser paced Ss growth (than previously announced), North-East, Odisha, Andhra Pradesh and Madhya Pradesh. Religious destinations, Metro cities that have limited supply creation over 15 years, demand in these markets will grow to absorb and even foster new supply. BLR is not highlighted as it continues growing across its micro-markets

Challenges

Achieved completions and conversions remain below the chain indication of annual Ss growth. Net growth has remained at 15k annually for the last 3 years due to substantial deflations. Core demand displacement will create long-term challenges. Leisure destinations are more primed to weddings; game park resorts are for leisure. The former takes away focus on leisure marketing (e.g. Jaipur & Udaipur); the latter causes undue crowding at game parks to the detriment of high-paying inbound enthusiasts and long-term high-value demand flow. Talent and skill shortage, Weekend demand at city hotels, Burgeoning air fares.

India 2025 – Highlights

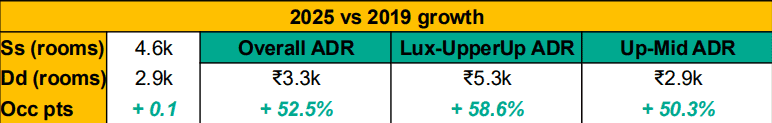

The Key Results

The largest supply addition in any year, as openings and conversions crossed 19k. Net inventory growth of only 15.5k rooms due to substantial deflags. Slower demand growth (relative to 2024) was fundamentally due to negative external events, within India and the wider west As ian region. Rate growth continued to be positive across segments; if anything, the Up-UpMid segment could do better.

64% Occ is a 0.5% behind 2019, but it is in positive territory considering over 40% supply growth between 2019 and 2025. Lower saturation factors in leisure markets, newer tier 2, and

tier 3 markets and even religious destinations, as compared to larger business cities, could cause future all-India occupancy to remain in the mid to high 60’s for several years.

Performance Landscape

Supply and Demand Growth

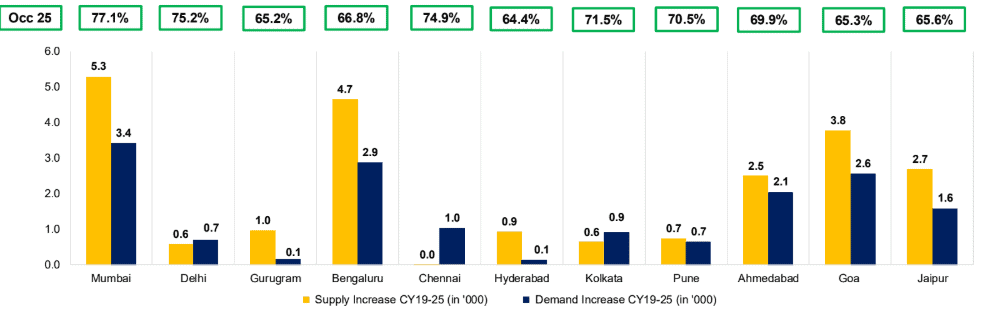

Occ is a prime parameter. However, by itself, Occ is an insufficient measure in a rapidly growing market. The underlying demand and supply measures gain relevance. Bengaluru’s 66.8% and Ahmedabad’s 69.9% Occ seem modest (an under-achievement even). But Bengaluru had 4.7k new rooms (+32%) since 2019; Dd has also grown 30%, reflecting the need but limited latency. Ahmedabad’s +2,100 rooms demand responded well to +2,500 rooms supply growth, enabling Occ pull up to nearly 70%.

Chennai reflects the need for supply; Delhi reflects the ability to absorb new supply but needs more inventory; Gurugram needs sustained demand creation initiatives.

2025 Performance – Special Features

Occ pecking order changes: Mumbai continues to lead at 77.1% (down 0.3 pts); Indore retains 2nd rank; Delhi displaced to 4th place by Coimbatore (75.5%). Lucknow drops below 70%; Chennai (rising to 74.9%) retains 5th rank

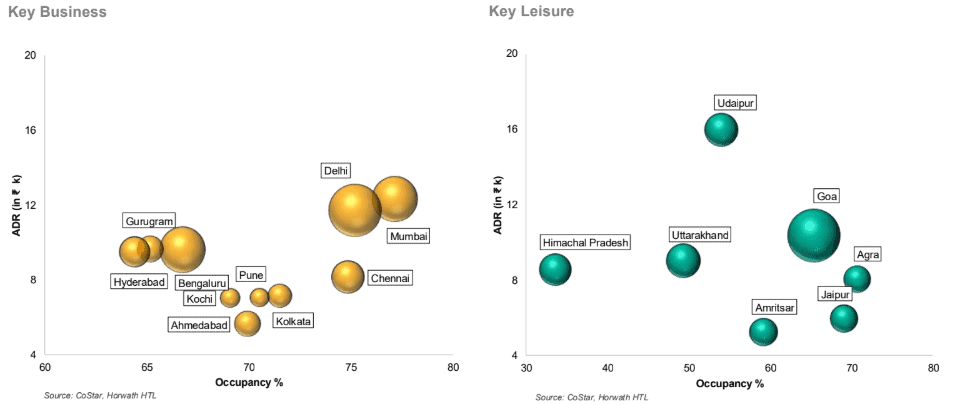

Among leisure markets: Agra into the 70’s (70.7%), Goa & Jaipur in the mid 60s, Udaipur at 54%. Varanasi crosses 70%

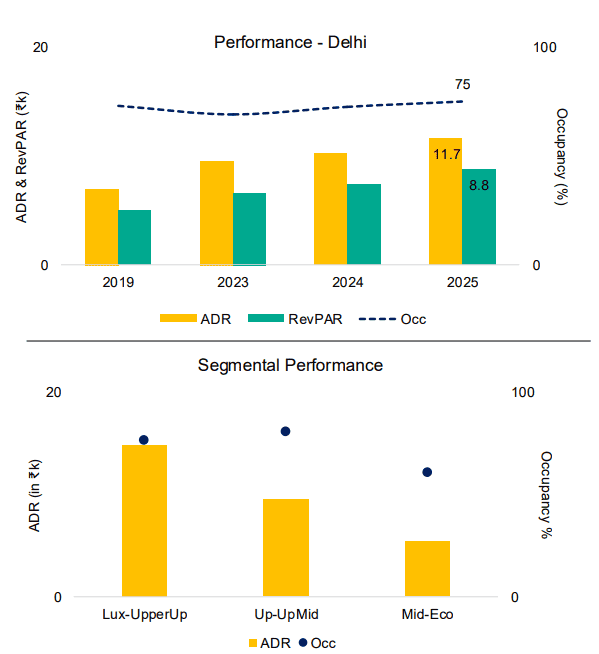

5-digit market-wide ADRs: Increases to 5 markets, joined by Jodhpur. Udaipur leads at 15.9k, followed by Mumbai at 12.3k, Delhi 11.7k, Goa and Jodhpur (10.3k)

Lux-Upper Up ADR – continued positives

Leisure leaders – Udaipur rises to 25.7k; Jodhpur crosses 22k, Jaipur 16k, Agra 15k; Goa drops 2.7%, down to 15.8k

Business cities – Mumbai crosses 15k, Delhi just under; BLR & Gurugram 14.3k, Hyderabad in the teens, Pune crosses 10k

Up-Up Mid ADR: Delhi, BLR and Chennai score well with Delhi taking lead spot at 9.4k (only market > 9k). Growth in some leisure markets but decline in Goa and Uttarakhand

M-E Occ: Chennai added 10.2 pts, Vizag 8 pts, Delhi 7.0 pts as the major gainers. Chennai & Coimbatore join Mumbai & Indore in the 70s.

M-E ADR: healthy teens % growth for several markets; Delhi crossed 5k comfortably, Chennai and Lucknow into 4k levels

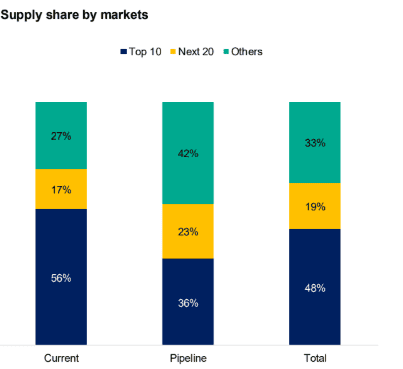

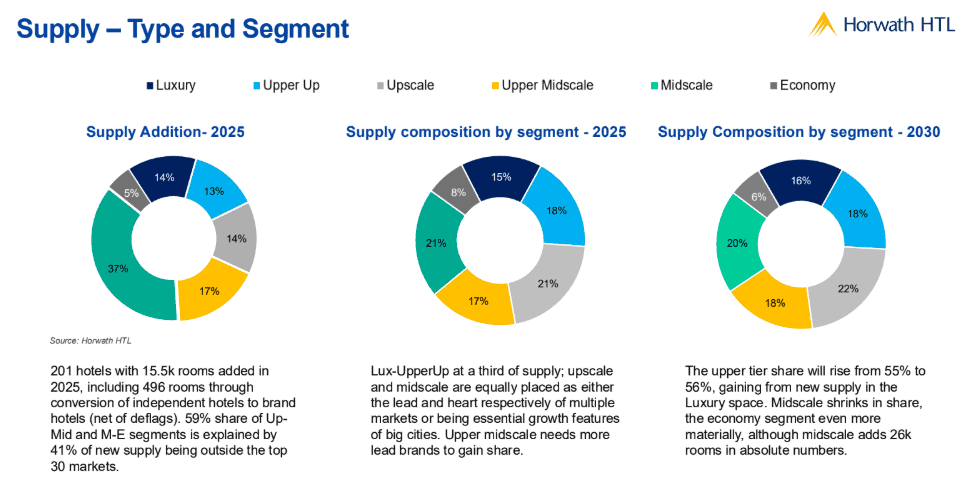

Supply: Inventory at 216k rooms, up by 7.7%; Pipeline grows by 39k (net) during the year, to 144k. If implemented, this will take inventory to 360k rooms by 2030. But the new supply delivery is below the project timelines. Will the extensive pipeline be delivered on time? More likely 300k rooms by 2030

Supply Composition

Supply Transformation

Currently, the 10 largest markets by inventory have at least 5k rooms each. These comprise the 6 metros, Goa, Jaipur, Pune and Ahmedabad. These will remain the top 10 markets even in 2030, with eight markets having > 10k rooms, Ahmedabad and Kolkata having > 7k rooms.

The next 20 markets comprise a mix of business, leisure and religious centres. These are spread across India, with 4 in UP, 2 each in Uttarakhand, MP, Gujarat, Punjab and AP, 1 each in 5 other states, and Chandigarh. These cover 6 cities/clusters (of the 7) identified for creating City Economic Regions by 2030.

By 2030, only Udaipur and Lucknow will cross 5k rooms inventory, with Amritsar just short, Indore & Chandigarh getting closer to 5k. Yet the aggregate share of these 20 markets will be <20%. Ss and Dd spread over >400 other markets reflects regional growth & diversity, business and leisure potential and the relevance of pilgrim locations. The top30 markets cover only 15 state capitals, leaving growth potential in the ‘Others’ category.

The relevance of airports and good motorable roads is vital for driving demand growth and supply expansion. High-speed rail also adds mobility.

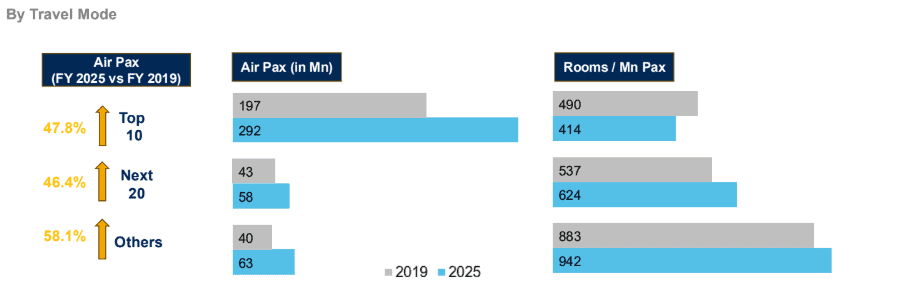

In aggregate, the Top 10 markets have 414 rooms per Mn air passengers for 2025. Jaipur, Pune and Goa were major outliers, gaining from road connectivity to major demand sources in a convenient drivable distance. The reduced ratio, from 490 in 2019, is the outcome of more local travel and better utilisation of assets, while pointing to growth potential.

The Next 20 markets with an average of 624 rooms per Mn air passengers reflect demand growth potential. Ludhiana, Agra, Nashik, Udaipur and Surat are major outliers with reliance on regional rail and road travel; yet each now has better airport access (Agra gaining from Jewar airport) to support demand growth and wider market growth.

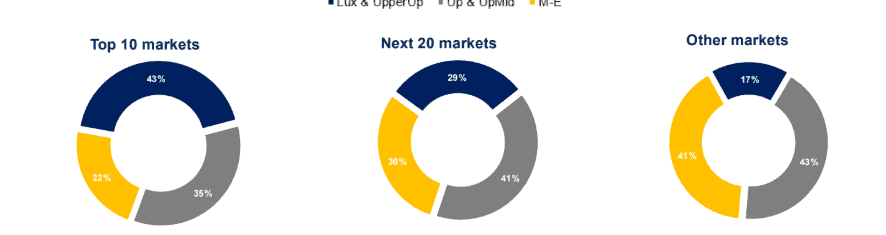

The colour of the pie changes as you traverse through India – from the larger blue of the more urban Top 10 markets, to the urban but evolving next 20 markets, to the more earthy rest of India.

The biggest challenge is for the Upscale segment – how high should the product be pitched in a market where you are the leader, or how much can you drop cost (and quality) in seeking to earn more by cutting corners.

Lux-UpperUp has potential in Other Markets, particularly leisure markets; the tendency to overcrowd – to put in the brand, with inconsistent profile – needs to be restrained. 43 % of the new supply in 2025 occurred outside the top 30 markets.

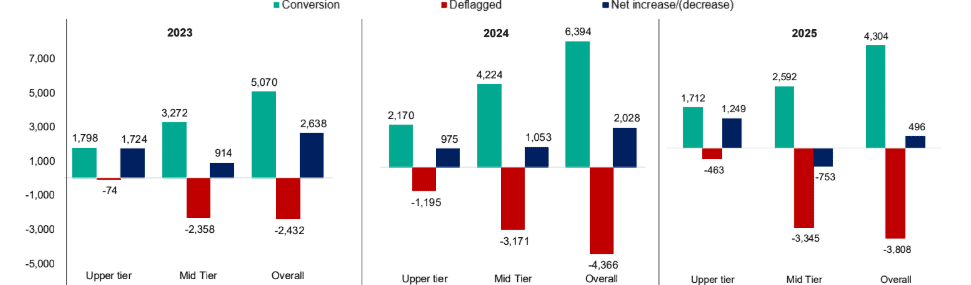

Supply – Conversions 2023-2025

Just 496 rooms net growth does precious little for the sector. 5.2k net rooms addition over three years. 10.6k rooms deflagged over 3 years. It reflects the risk of chasing numbers & dots on a map – the gain is short duration and drops chain value. The upper tier has a lesser incidence of deflag – largely quality-based or driven by owner strategy.

The mid-tier is causing the deflag losses. However, some losses are a result of correction of lesser value choices made during an initial growth phase; to that extent, we could see a reduction of deflag needs and faster overall Supply growth. Franchise based number motivated growth needs to be more judicious to avoid regular chopping efforts.

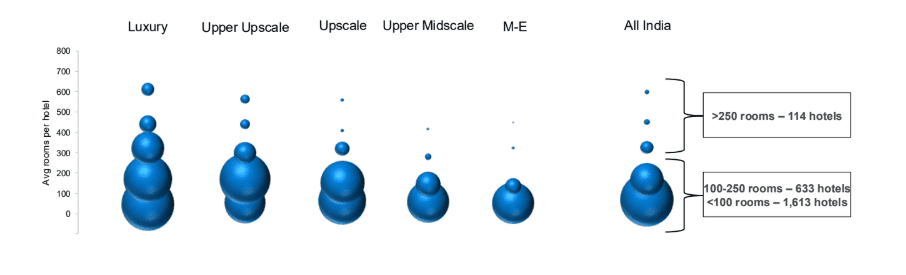

Supply – Size

Obese – way too squat. The frame has very little muscle. UpperUp has only improved to the point of a huge potbelly. Only 27 hotels with > 400 rooms; only 7 such hotels in pipeline. Size creates value – one hotel with > ₹8 bn revenue; two hotels with over ₹5 bn revenue; these are businesses/entities by themselves.

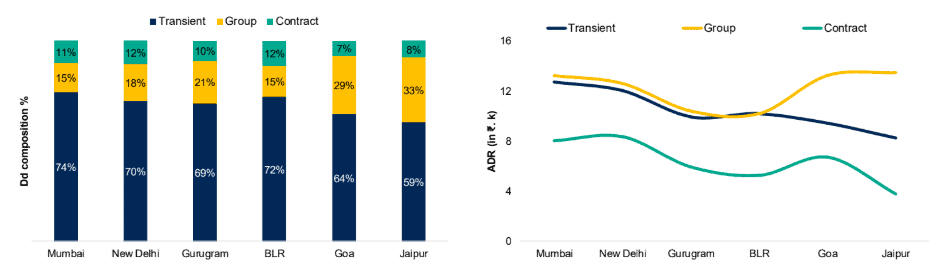

Demand Composition – Overall

Group share is distinctly higher in the leisure markets, with Goa at 29% and Jaipur at 33%. The importance of groups to Delhi and Gurugram, relative to more business-driven Mumbai and BLR, also emerges; Gurugram, with 21% share, does reflect large MICE activity.

The rate advantage from Groups is distinctly substantial for Goa and Jaipur, and more muted for the 3 metros and Gurugram.

More MICE-driven group demand at BLR (relative to weddings) causes Transient & Group rates to converge.

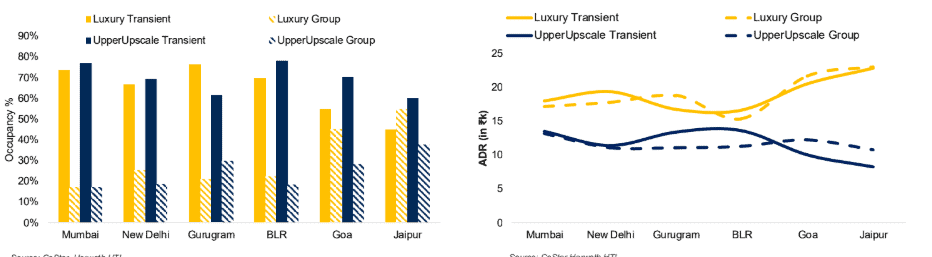

Demand Composition – Lux-Upper Up

Larger Group share in the Lux & UpperUp segments than the respective overall city levels. All markets except Mumbai had Lux group share > 20%; Goa & Jaipur at 45% and 55%.

UpperUp Group share relatively lesser across markets, except Gurugram, with 30%; Jaipur at 37% reflects the use of city-based (not Kukas) hotels for business travel and leisure.

Lux ADRs for Transient & Groups are comparable with Transient rates, being higher at the 3 metros. Gurugram had the largest gap of ₹2k in favour of Groups.

Several key luxury resorts in Goa & Jaipur are more leisure-focused. UpperUp rates are lower than Lux rates by about 25% (Mumbai) 40% (Delhi). Gurugram drops group rates by 41%, but transient rates by only 20%. Goa & Jaipur drop Transient rates by 51% and 64%, about 10 points higher than the rate decrease for Groups.

Performance Analysis

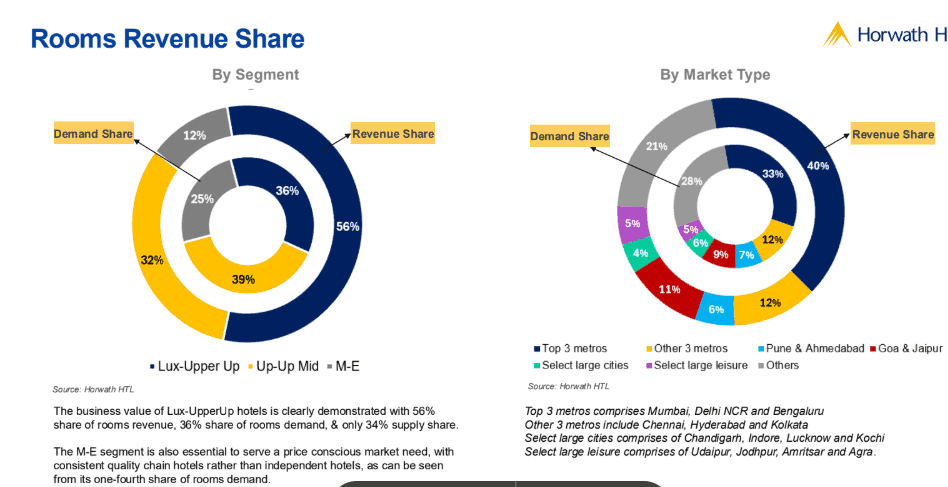

Segmental Performance

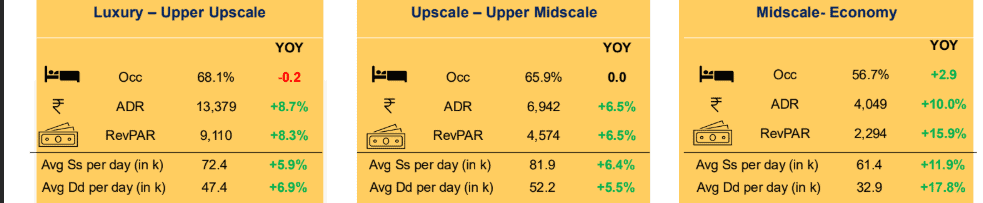

Luxury – Upper Upscale

Occ slipped marginally, with several metros and some leisure markets in the negative zone. ADR gainscontinue, adding ₹1k all-India.

The top 10 markets had mid-70’s Occ. Pune and Jaipur (Occ gain); Gurugram and BLR (Occ drop), were inthe 60s.

Top 10 markets except Goa gained ADR; Punecrossed ₹10k, but Kolkata and Ahmedabad remain<₹10k.

Ss growth of 20k rooms since 2019 is being steadilyabsorbed, with Dd growth of 13k rooms. Key leisuremarkets added 7k rooms Ss and 4.9k rooms Dd in this period.

Upscale – Upper Midscale

Steady but could be more impactful – both are critical for overall success as the segment has 38% supply share. 21k & 13k rooms supply & demand growth since 2019 are acceptable but not ambitious.

Several business cities (Top 10 markets and others) had mid to high 70’s Occ (Mumbai & Delhi at 80%). Bengaluru & Delhi were the stand-outs in ADR, adding > ₹1k.

74% pipeline growth will need deeper demand creation (beginning now) for absorption. Manufacturing and service sector push should help.

Midscale- Economy

Gaining slowly, but a long way to match potential. Double-digit ADR growth in several key business cities. But Kochi, Indore, Vadodara, and Chandigarh grew at just 5%-7.5%.

These numbers include hotels with aggregatorgroups. If these were excluded, Occ, ADR, and

RevPAR for 2025 are 64.1%, ₹4,666 and ₹2,988 – much more positive.

52% pipeline growth (other than aggregators) iscommensurate with the Ss side potential. Its absorption could take longer without sustained brand effort.

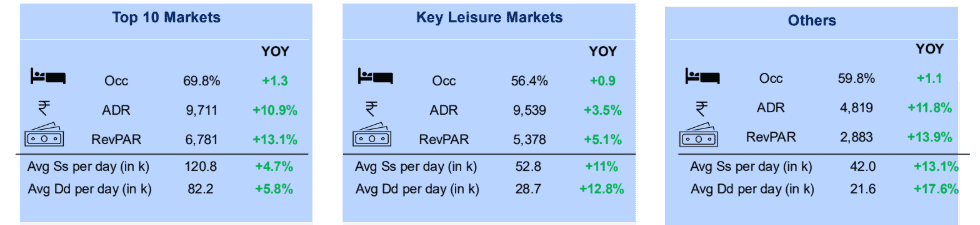

Performance – By Market Category

Top 10 Markets

Bengaluru, Chennai, Hyderabad, Kolkata, Ahmedabad, Pune, Goa and Jaipur Mid 60’s Occ in BLR, Hyderabad, Jaipur and Goa have pulled overall Occ to below 70%.

ADR levels are an outcome of 43% supply of Lux-UpperUp hotels and 22% of M-E hotels.

Limited supply growth over several years create growth opportunity, given the demand potential of the Top 10 markets.

Key Leisure Markets

Key Leisure Markets comprise Rajasthan, Kerala, Goa, HP, Uttarakhand, Agra and Amritsar.

Leisure had several headwinds – demand diversion to Maha Kumbh, Op Sindoor, climate factor and Indigo airline disruptions. Besides, demand dilution in Goa due to rate and cost competitiveness & visitor fatigue.

Rajasthan played a lone innings to counter the decline in Goa, HP, UK & Amritsar.

Others

Business cities and towns, state capitals, leisure markets & pilgrim centres, spread through India and serve national and regional demand.

Commendable Occ in the face of 12% supply growth. And a rate push too, as more mature brands gain ground in these markets.

Space to grow Occ by 7 to 8 points over the future, thereby making much larger contributions to the sector. ADRs would improve to,o but would be restrained by larger Midscale supply in tier 2 and tier 3 markets.

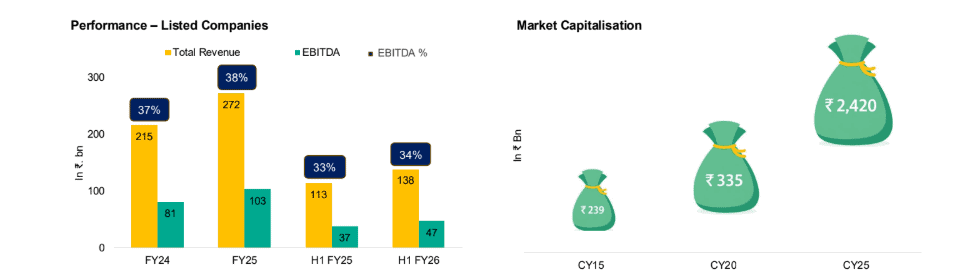

Listed Companies – Performance and Market Cap

Over 10 times growth in market cap of the sector – from a combination of more listed companies, higher profits, and higher multiples. Larger listed company presence and management (45% share of chain-affiliated supply) will lead to more responsible asset management, financial prudence, consolidation and more stable growth.

The underlying substance is the aspect of better value creation through strategic growth initiatives, brand building, expansion and diversification, asset and service creation, and better messaging of the essential character and economic contribution of the sector.

Analysis of Key Markets

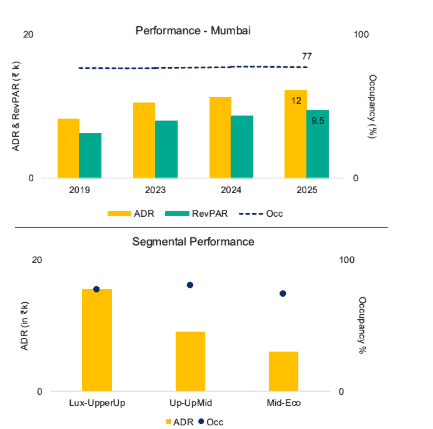

Mumbai (1)

Nominal 0.2 pts Occ decline, though ADR & RevPAR grew by over 8%. Occ decline was due to a 0.6 pts drop in Lux-UpperUp Occ.

Lux-UpperUp ADR at ₹15.4k leads all business cities; the absolute growth for 2025 was slower than BLR, Hyderabad, Delhi & Gurugram. Room rates vary sharply across micro-markets. Lux ADR for South & Central Mumbai (₹22.4k) is ₹8k ahead of Lux ADR for Mumbai-East micro market.

Mumbai Central and South have revived big-time with 80.7% Occ compared to mid/high 60s Occ for several years. And ₹18.5k ADR. Lux-UpperUp hotels had 81.6% Occ with ₹20.8k ADR. The Coastal Road is a game-changer.

City Up-UpMid Occ rose nominally to 80%; it lost lead rank to Delhi, with just 8% ADR growth to nearly ₹9k. Segmental leadership continued for the M-E segment, with ADR almost touching ₹6k.

Mumbai (2)

The Mumbai East micro-market is more densely supplied and competitive, but also seeing the largest demand generation. This market enjoys the ripple effect of demand displacement from BKC when events occur at Jio World Convention Centre. Supply addition of 3.7k rooms since 2019 has enabled 2.3k rooms materialised demand growth, with likely significant latent demand.

While 1.9k rooms supply growth in 2025 (effectively 1.2k for the year) is a part of the cause for the soft performance. 6k rooms are underway (34% supply addition) with enough demand capability for absorption, including the just-opened Navi Mumbai International Airport.

With a quarter of the year lost to monsoons, demand growth needs a deeper approach – quantity over pricing? Mumbai needs to expand its weekend and off-season leisure and MICE business. 80%+ Occ must be the aim.

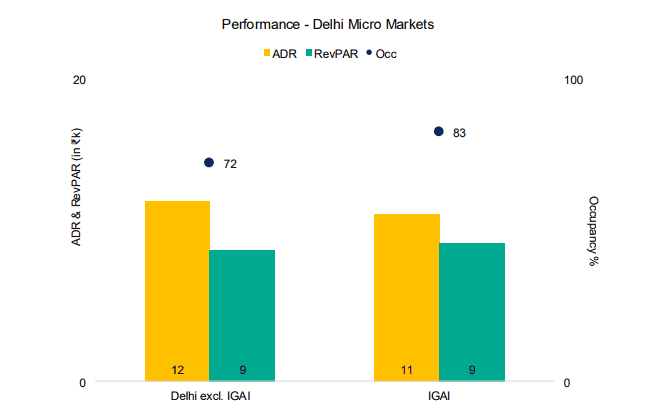

Delhi (1)

75.3% Occ (+2.5%) for a capital city with a virtually stagnant supply side since 2018 leaves one thirsty for more.

As does Lux-Upper ADR, which is nearly ₹15k, but just ₹572 ahead of BLR.

Hearteningly, the Lux segment ADR is ₹18.9k with 75.5% Occ and 14.3% RevPAR growth over 2024

Is it Op Sindoor? Yes, partially. Is it AQI – for sure, yes, but partially so.

It’s more from the shift out of business travel, loss of foreign leisure travel and far greater reliance on weddings, delegations and events than the city should have.

Delhi (2)

IGIA with 82.6% Occ is a key micro-market and will gain from new supply and new commercial spaces as demand creators.

Up-UpMid Occ crossed 80% and ADR rose to ₹9,441, led by 85.6% Occ and ₹10.5k ADR at Aerocity micro-market (35% of segment supply).

M-E continues to grow with +7 pts on Occ and +₹800 in ADR, giving a 33% RevPAR growth.

With a modest pipeline, there is space for further growth. Bharat Mandapam, Yashobhoomi Convention & Exhibition centre and others will create more group and event demand; we need to bring back a business and leisure core – amidst high AQI? That’s a real task.

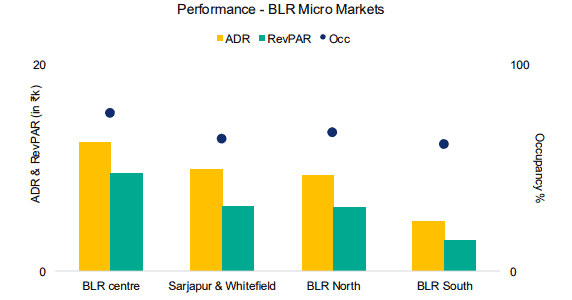

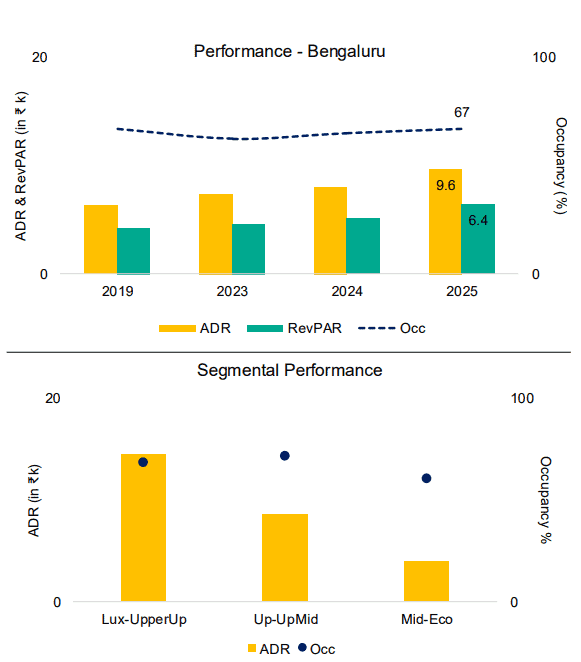

Bengaluru (1)

Traffic jams; supply jams curtailing Occ; ADR is a sweet jam.

Occ improved to 66.8% (+1.9pts over 2024). Nominal growth over 2019 must be seen in the context of large supply growth.

The market has used demand concentration periods to its advantage in room rates, enabling major rate gains.

City centre micro-market, a major CBD, has been particularly strong with 76% Occ and ₹12.5k ADR; Lux-Upper Up ADR for this micro-market is ₹16.5k with 76.2% Occ.

Sarjapur-Whitefield micro-market yet to receive full gain from IT sector return to WFO; 63.5% Occ is modest, though Lux-UpperUp Occ is better at 67.9%. Weekends and holiday periods are a challenge.

Bengaluru (2)

North BLR has 2.4k supply growth. Its 66.5% Occ and ₹12.5k ADR are positive; substantial supply is underway in this micro-market (6k rooms), together with 43.7 msf commercial space and a rapidly widening airport.

City-wide supply pipeline of nearly 10k rooms (+53% to current supply) could see continued moderate (mid 60’s) occupancy, with overall rates dependent upon supply-mix from time to time. Newer hotels must create staycation and weekend attractions to push demand and occupancy.

An event arena and convention centre in the Aerotropolis will be a demand driver, as will the airport expansion itself (29 mn pax in FY19; up to 36 mn pax for FY25, expected to rise to 90 mn pax by FY30).

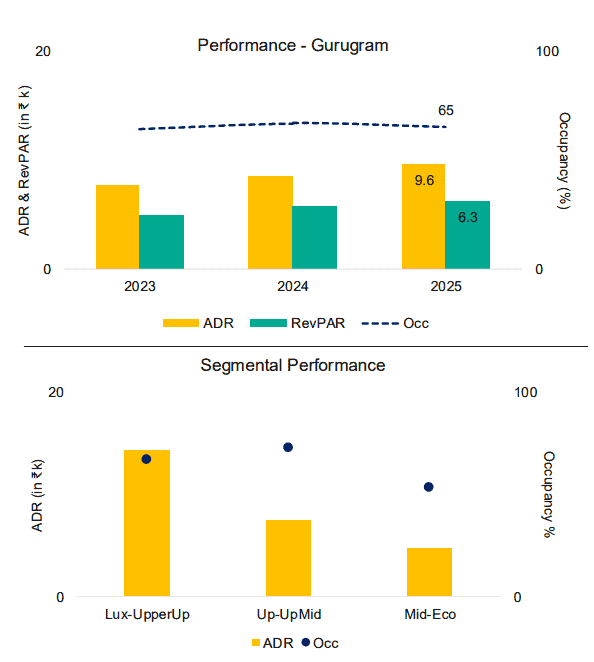

Gurugram

Business-travel and MICE-driven, with weddings, leisure and crew as support elements, Gurugram is oddly short of momentum. Supply growth of 1k rooms since 2019; shallow 200 rooms demand growth.

Occ is largely in the low to mid 60’s, touching 70% only once over 15 years. More like a suburban Delhi market, not as a key core of business in Delhi NCR.

Positive ADR levels, with +₹3.5k in the last 3 years, reporting ₹9,633 for 2025. This is mainly led by Lux-UpperUp ADR rising from ₹9.7k to ₹14.4k.

Up-UpMid Occ declined to 72.5%; rate growth to ₹7.5k ADR, curtailed RevPAR decline to just -0.2%.

M-E segment is grossly below par at 53.2% Occ.

The market needs to widen and ramp up its demand reach, particularly as new supply occurs in Aerocity and around Yashobhoomi.

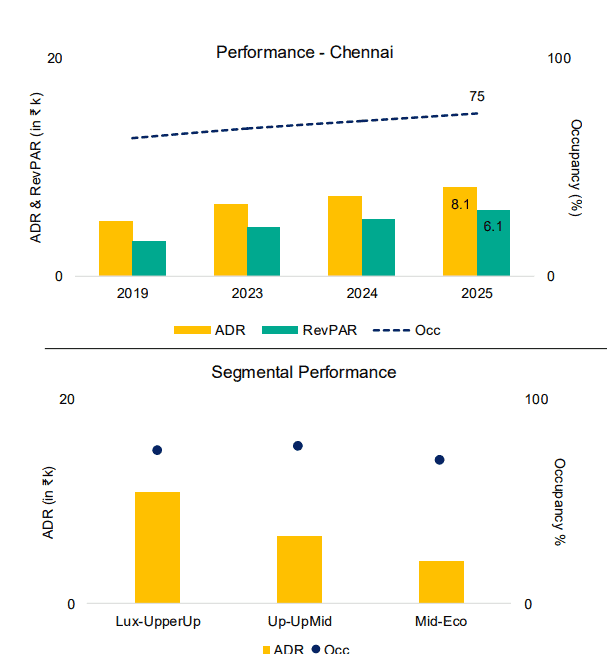

Chennai

1,100 rooms, new demand over 2019. Stagnant hotel supply; potential for conversions & supply expansion.

Highest ever Occ; ADR crossed ₹8k; RevPAR +16.9% • Occ, ADR and Demand growth across all segments; Lux-UpperUp ADR nears ₹11k.

While Lux-Upper Up and Up-Up Mid rates significantly trail Bengaluru and Hyderabad, Chennai has typically been rate conservative – from that viewpoint, the ADR reflects a positive trend.

2.8k rooms pipeline is modest; reflects only 3k rooms added over 12 years. Further supply is under discussion outside the city core.

City has growth potential – 21.2 msf commercial spaces, substantial infra projects, an expanded airport and a greenfield airport.

Potential for RevPAR growth over the next 3 years.

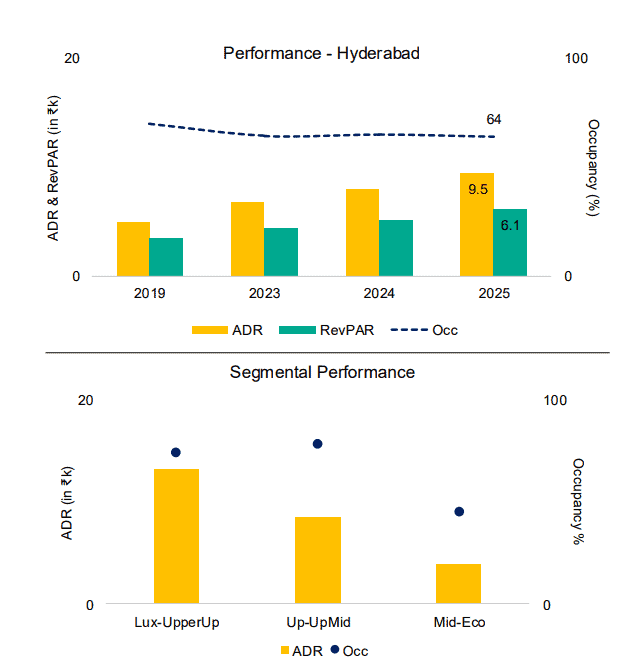

Hyderabad

Always a mystery – excellent infrastructure, risk-taking, but comparatively softer results.

Paradox of 19% rate growth; 0.8 pts Occ drop, and just 137 rooms demand growth since 2019.

Lux-UpperUp demand rose by 444 rooms since 2019; ADR by 85%. Eyewidening ADRs at some hotels. These point to stronger upper-tier demand and potential. Yet, the 2025 segment Occ shed 0.2 pts, while there is space to grow over its current 73.4%.

Substantial expansion underway – Ss pipeline of 2.9k rooms & 30+ msf commercial space to create demand.

Expect to pay hefty rates for rooms through 2028, and look forward to a wide range of Lux – UpperUp brands.

Will water be a constraint?

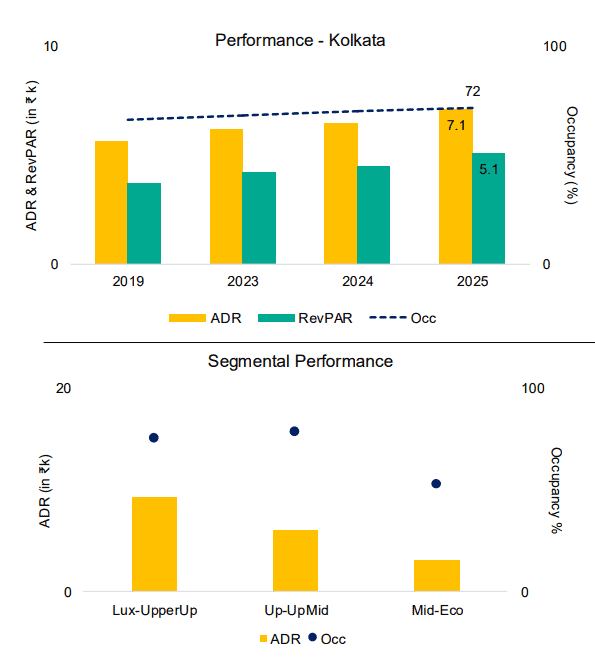

Kolkata

71.5% Occ in spite of the sharp decline in travel from Bangladesh is creditable. More so with demand rising by 185 rooms. And a 10.2% ADR gain to boot, breaching ₹7k.

74.9% Lux-UpperUp Occ is just shy of the 2007 peak. But ₹9,270 ADR is the highest for this segment with a long margin.

Up-UpMid & M-E segments also pushed ADR to ₹6k and ₹3k, respectively.

The supply pipeline of 2.1k rooms will add 40% inventory through 203,0 along with commercial space of 4.7 mn.

Besides, The Oberoi Grand will re-open post a full renovation. These will need core demand sources to sustain business – weddings and MICE cannot be the only answer.

As a travel hub for visitation to NE India, Kolkata could gain from transit demand as more hotels are built near the airport.

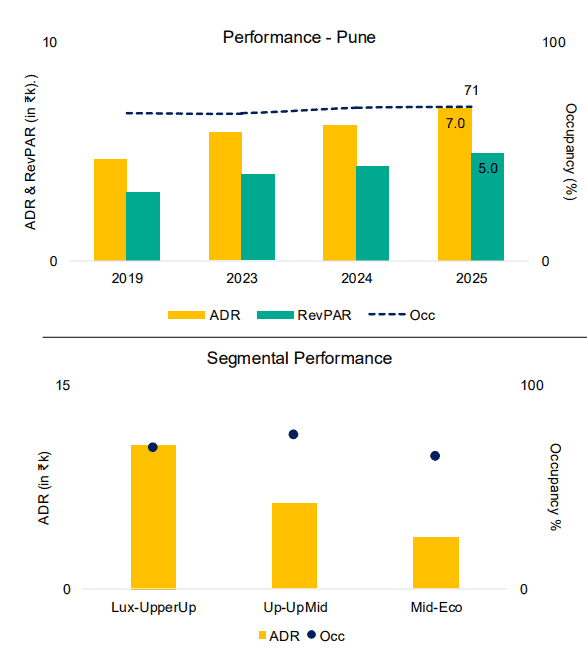

Pune

Best performing non-metro business city.

70.5% city Occ, ₹7k city ADR and ₹10.5k Lux-UpperUp ADR are very positive stand-outs. But only 757 rooms supply and 654 rooms demand addition, since 2019.

Supply pipeline of 1.9k rooms to take city inventory > 10k rooms. Pipeline of 30+ msf commercial space and manufacturing/logistics facilities across multiple micro-markets should create demand strength. The budget announcement to push manufacturing in Pune will help.

Dd concentration from business travel and residential MICE; limited other demand is a constraint to deeper Occ.

Supply pipeline has no Lux hotel and modest Upper-Up rooms, enabling this top tier to push rates and occupancy.

Pune will gain from the Navi Mumbai International Airport and the enhanced Expressway access to Mumbai.

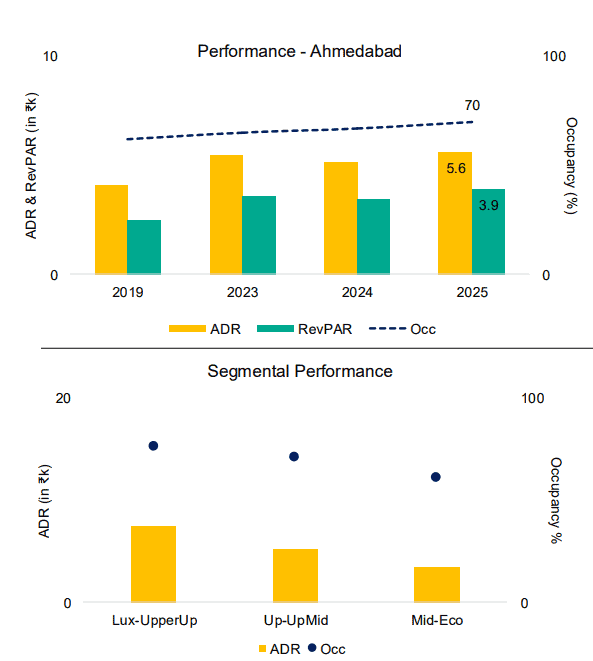

Ahmedabad

After 3 years of mid 60’s stagnancy, Occ has increased to 69.9%, at an ADR of only ₹5.6k. City inventory is larger than Kolkata; its ADR levels compare with non-metro cities such as Lucknow, Coimbatore and Indore, and trail Chandigarh and Vizag.

Market size growth has been significant, adding 2.5k rooms supply and 2.2k rooms demand since 2019, reflecting 70% and 94% growth. Another 28% supply growth is in the pipeline, and this will increase rapidly as the city aims to secure major sporting events.

Segmental Occ and ADR reflect the market character of a limited demand core and an amalgam of varied elements – 76% Lux-UpperUp Occ comes with a modest ₹7.5k ADR; 71% Up-UpMid Occ at ₹5,263 pales when seeing that 2022 Occ was at 70.5% and 2023 ADR at ₹5.2k.

The city will grow without doubt. GIFT City will continue to attract increased business. Development in the wider region of the city (Dholera and Lothal) will create travel demand through Ahmedabad.

Paradoxically, for a state and people that have a modest sporting base, Ahmedabad may become the sports venue of India.

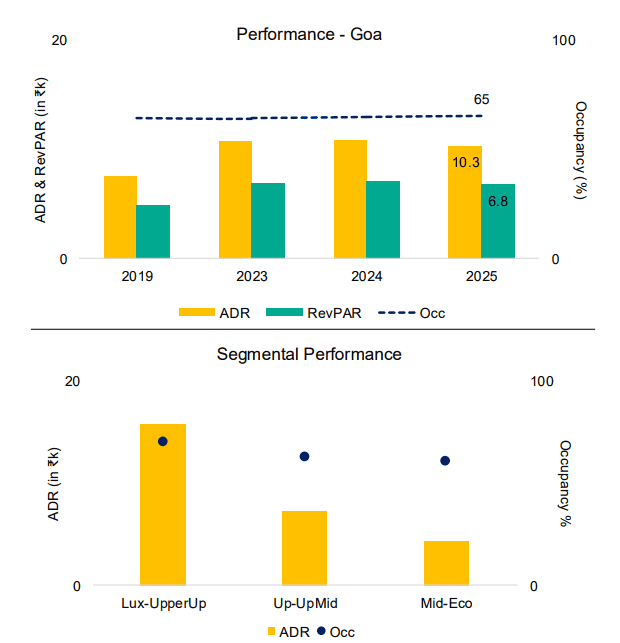

Goa

Suffering from Volume over Value, Rate over guest experience; Lack of new beach resorts. Are we losing the real Goa? The Goa of yore?

A slight uptick in Occ to 65.3%, marginally for Lux-UpperUp and more for M-E; but Up-UpMid dropped 0.9 pts.

ADR dropped by ₹481, with Lux-UpperUp going below 16k after 2 years and only M-E gaining 1%.

5.9k rooms added in the last 10 years, 4.2k of these below the Lux-UpperUp segments. Only 3.6k rooms demand growth, impacted by alternative accommodation targeted at offering more private holidays. Further pipeline of 7k rooms could take a while to be absorbed.

Goa will come back, but needs supportive policy and incentives. Value focus needs to be prime across all service needs. Newer projects could face stress unless sensibly capitalised.

Goa needs a strategy to recoup interest from upmarket foreign leisure. Does it have the will to make the necessary changes for this?

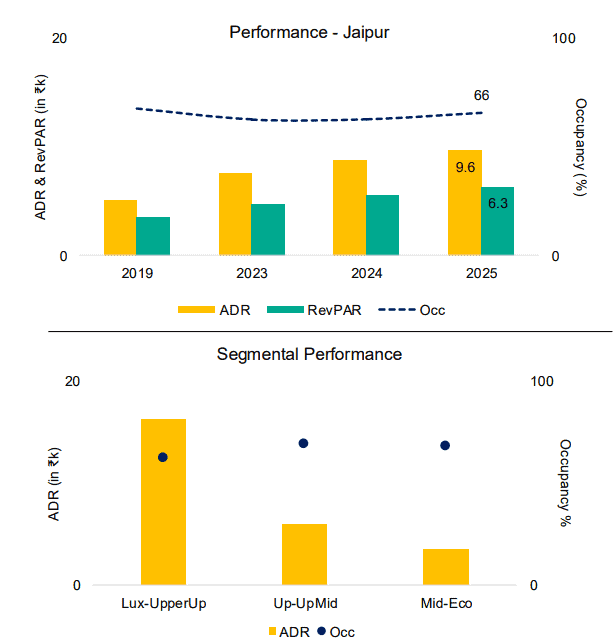

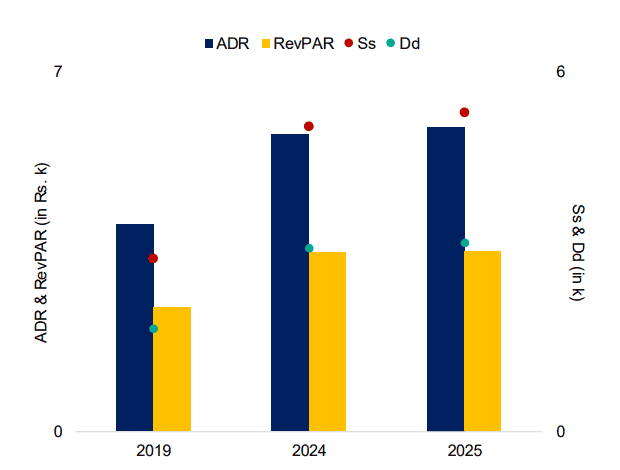

Jaipur

Luxury and class on the one hand, volumes on the other. And volume wins.

Hotels with 200+ rooms comprise 31% of the city supply, with a total of 2,650 rooms. Such hotels are 40% of the pipeline. Weddings, MICE, business travel and leisure are the order of business.

3.5k rooms added in the last 10 years, nearly half of these as Lux-UpperUp hotels. 2.7k rooms demand added, 40% of this at Lux-UpperUp hotels.

65.6% Occ for 2025 (diluted by Op Sindoor), is +2.9pts over 2024 but below 68% of 2017-19. Lux-UpperUp Occ at 62% is underdone by a lack of demand width.

Lux-UpperUp ADR at ₹16.2k is healthy but way below Udaipur & Jodhpur. Upper-Up ADR is not upping up.

JECC & DMIC Expressway are positive value-add for the city; airport expansion will help significantly.

Udaipur

The City of Lakes remains a lead choice for destination weddings. The dream is fulfilled, the splendour experienced, the recognition derived. At a price, of course, with Lux-UpperUp ADR of nearly 26k – the cost of luxury is well above ₹50k.

Leisure comes distinctly second, in business priority; the thirst of Gujarat keeps it more substantial than Jaipur.

54% Occ is the result; no longer the 60’s achieved in 2017-19. Up-UpMid and M-E ADRs are very modest.

2.4k rooms added since 2019 (130% growth), almost entirely built with weddings in focus; another 50% supply on the way. Crowding kills exclusivity; the badge of honour then is the resort and not the destination.

Udaipur has its own special charm for leisure, and one hopes it isn’t lost amidst the wedding euphoria.

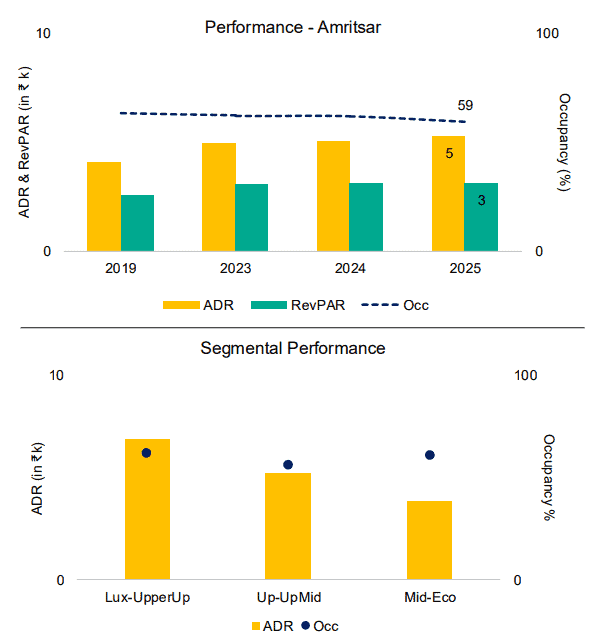

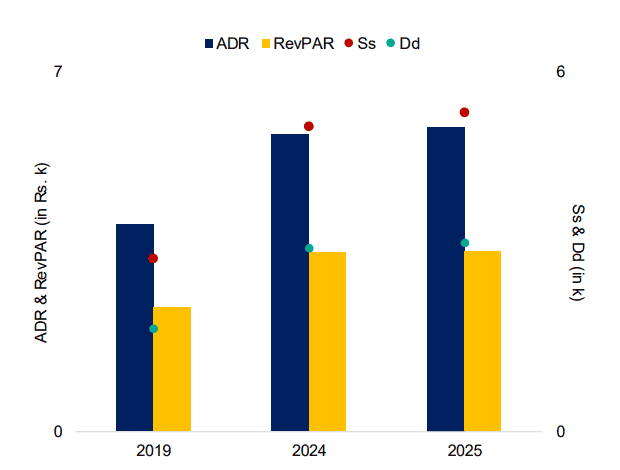

Amritsar

2k rooms new supply in last 10 years; <1.1k rooms demand growth.

Occ in the low 60’s for several years; declined to 59.2% for 2025 due to Op Sindoor and 11% supply increase.

ADR at ₹5.2k; +₹800 over 3 years.

ADR gap between Lux-UpperUp and Up-UpMid is only ₹1.7k; Lux-UpperUp ADR <7k.

Robust pipeline of an additional 2.1k rooms appears unsupported by market reality, even considering the potential for the banquets business.

Other Markets

Vizag

69.4% Occ, at ₹6k ADR. ADR up by ₹2k over 2019

Largely stagnant inventory limits achieved Dd growth; strong latent demand for business, leisure, MICE & wedding needs.

New airport at Bhogapuram (north of the city) will boost growth & change some dynamics, though the city centre will remain strong.

Potential for 120% Ss growth to be absorbed, even if rates remain moderate. 55% Lux-UpperUp share of Ss pipeline could add positivity to demand & rate structure.

Indore

2.1k rooms; pipeline of equivalent rooms.

strong 76.5% Occ; ADR only 5.3k, mainly from UpUpMid and some Upper-Up hotels.

Growing business city, potential target for GCCs and the IT sector; growing airport.

Dd growth will occur to support inventory growth

Can Indore foster high ADRs to support >1.4k new Lux-UpperUp rooms?

Longer project cycles, with delays from stated targets, could help moderate the achieved growth pace.

Lucknow

The city helms a rapidly growing state and region, besides growing its commercial & retail capacities

67.9% Occ is +6.4pts over 2019; 71.5% for 2024 had gained from Ayodhya Temple opening & elections.

Steady ADR growth, at 5.6k; 8.1k for Lux-UpperUp with 78% Occ.

+839 rooms Ss since 2019; +735 rooms Dd. Can the city sustain further 122% Ss growth? The signs are positive.

Expanded airport and multiple new expressways will support visitation.

Kochi

12th rank nationally on inventory with 3.5k rooms; limited pipeline.

69.1% Occ at ₹7k; +11.6% RevPAR; ₹9.5k LuxUpperUp ADR, with +13.8% RevPAR. • Driven by business travel and regional weddings, IT hub expansion & Vallarpadam port will enable further drive.

Demand support from leisure and regional MICE. High air fares are a constraint to the national group Dd.

Ss growth near the airport and MICE feeder towns could impact core city Dd, but push for demand diversification.

Kerala

Sub-par relative to potential; often hit by weather & health factors.

State-wide inventory of 7k rooms is smaller than Pune or Gurugram.

45% RevPAR increase over 2017 is a recovery & not real growth.

Lux-UpperUp ADR of ₹11k is a positive.

Trivandrum has gained international tourism prominence; also growing as a business city

Numerous tourism options – need to portray a better & wider picture of quality facilities and experience.

Agra

Steady growth with Occ +2.2pts and RevPAR +3.7%.

Lux-UpperUp ADR at ₹15.3k has fostered 9.8% RevPAR growth for this segment, with 67% segmental occupancy being higher than for Jaipur and Udaipur.

Increased group and weekend leisure at the UpUpMid hotels is a big positive; rate structures need to be pushed up and would be helped with potential Dd push after the opening of Jewar airport.

States of Opportunity

North East – the Seven Sisters

Enchanting, alluring, unexplored. Nature, culture, topography, activity, wildlife, and natural resources. And a push for growth.

The region is vast. Assam predominates, but each of Meghalaya, Nagaland, Arunachal, Manipur, Mizoram and Tripura have their own attractions and character. Hill stations, plains, tea gardens, lakes and rivers, rainforests, wildlife parks. Kaziranga, Brahmaputra, and Manas are the lead. Arunachal is amazing (and a matter of nationalistic pride), even if access isn’t easy. Shillong and Cherrapunji have their own draw; there is much more to follow and add. And then the growing business opportunities.

Currently, the NE has 2.6k chain-affiliated rooms and 425 rooms from the Polo Towers group. Pipeline of 3.5k rooms. The potential is more.

Growth with sensitivity should be the mantra – the ecology is fragile, and the triumph of mere materialism will cause damage.

Odisha

A state with an attractive coastline, the 2nd largest coastal lagoon globally (Chilika Lake) and mineral-rich hinterland had only 668 rooms as chain-affiliated supply till 2020. This has expanded to 2.5k rooms, located in Bhubaneswar, Puri and Gopalpur with just one luxury hotel and 11 Upper-Up hotels. The Mayfair group additionally has 9 resorts with 843 rooms.

Odisha is actively pursuing tourism growth. It now has 3 airports and several expressways to facilitate movement between different attractions. Growing industrialisation, the services sector and real estate activity will drive demand. The active push of hockey creates a sports-led demand base.

Performance of Pilgrim Centres

Pilgrim Destinations

With travel arising from faith or necessity of custom, this segment has sustained demand irrespective of market conditions, except for security aspects. Chain hotels have gained from ready demand that used midscale independent hotels and lesser accommodations. Religious places draw even the upper strata of society, creating potential for upper-tier hotels – Haridwar, Varanasi and Tirupati are examples. In turn, the upper-tier hotels enable the upper strata to stay longer for a combination of multiple temple visits and leisure.

Several religious destinations have successfully combined with leisure, weddings and MICE to widen the appeal – resorts along the Ganges get top bracket ADR; Puri & Dharamshala are other examples. Rishikesh serves as a positive location reference for resorts that are up to 2 hours drive from the town core. Cricket stadia at Varanasi & Nathdwara will widen the visitor draw. Pushkar may have more resort rooms than camels.

Pure play pilgrim markets see Occ in the region of about 60% to 65%; Tirupati hotels can drive Occ to the 70’s, aided by MICE & weddings demand.

The pipeline of 19.5k rooms is significant, with numerous destinations yet not served / under-served. Projects in Ayodhya have slowed, amidst demand and other concerns; a critical mass of supply and activity should set this right. A religious plus leisure combo is essential for upper-tier hotels.

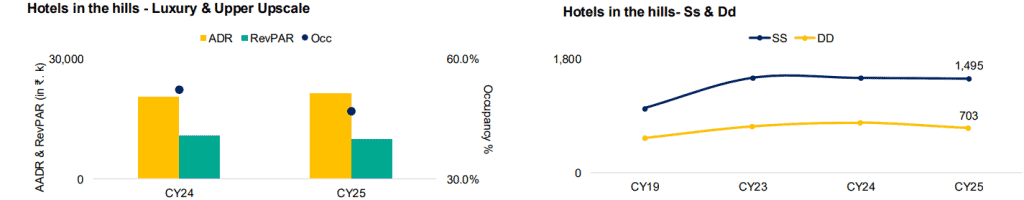

Performance of the Hills of Leisure

Hills Beckon Luxury & Upper Upscale Demand

The Hills have an unmatchable allure – majesty & charm, nature & colour, calm & peace, rest & rejuvenation. They draw more in summer, and the discreet in winter. But the current upper-tier supply of only 1.5k rooms with 700-800 rooms in demand tells a story of unplanned growth, missed opportunities and development challenges. And crowding at mid-value products and rates.

Demand has grown 10 times between 2014 and 2024, matching 9.5 times supply growth. Occ is generally in the low to mid-50’s. ADRs jumped from ₹13.3k to around 20k, particularly as new resorts opened in Uttarakhand and Kurseong. Lux resort ADRs have been ₹2k-3k higher than the Lux-UpperUp combined ADR. A slowing pace of growth shows value saturation.

Lack of new destinations and convenient airports, crowding of hills and access roads, are demand dampeners for the higher tier. Attention to destination carrying capacity will curtail crowds and value dilution and earn better for the destination.

Read More: News