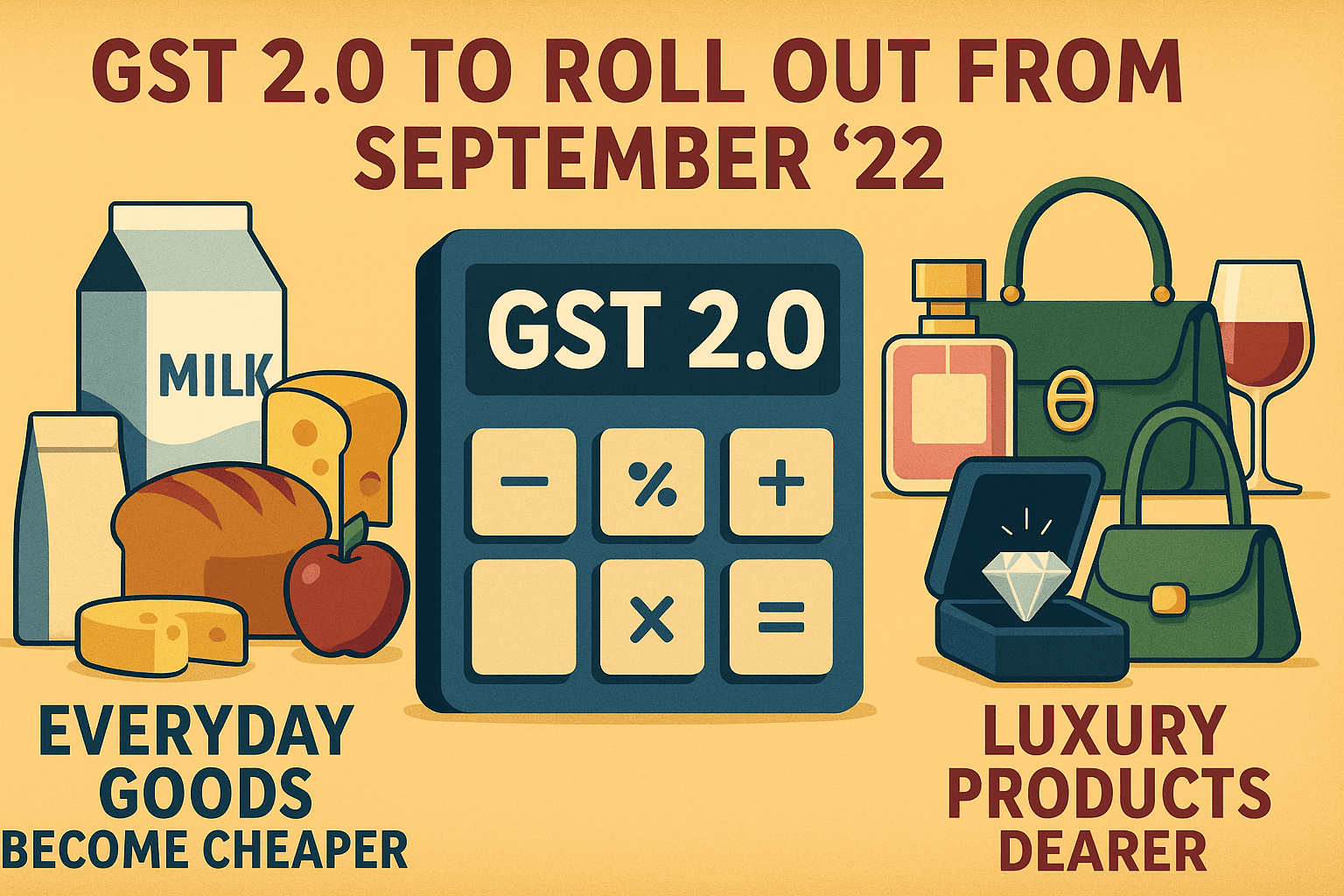

From households to farms, GST 2.0 slashes taxes on essentials, education, healthcare and appliances, while streamlining processes for businesses.

The Government of India unveiled Next-Gen GST Reform, billed as one of the most sweeping tax overhauls in recent years. Effective September 22, 2025, the move is positioned as a “Diwali gift for the nation” and is expected to ease the cost of living, strengthen household budgets, and accelerate India’s march towards building an Aatmanirbhar Bharat.

With the new framework, tax rates on essential goods and services have been rationalised, providing direct relief to households, farmers, students, and small businesses, while luxury and non-essential items face higher taxation.

Daily Essentials Become Affordable

Households will benefit from sharp reductions in GST on common consumer products:

- Hair oil, shampoo, toothpaste, toilet soap, toothbrushes, and shaving cream – reduced from 18% to 5%.

- Butter, ghee, cheese, and dairy spreads – down from 12% to 5%.

- Pre-packaged namkeens, bhujia, and snack mixtures – brought down from 12% to 5%.

- Utensils – cut from 12% to 5%.

- Feeding bottles, baby napkins, and clinical diapers – reduced from 12% to 5%.

- Sewing machines and parts – lowered from 12% to 5%.

Relief for Farmers and Agriculture

Agriculture, the backbone of India’s economy, receives significant tax cuts:

- Tractor tyres and parts – reduced from 18% to 5%.

- Tractors – down from 12% to 5%.

- Specified bio-pesticides and micro-nutrients – cut from 12% to 5%.

- Drip irrigation systems and sprinklers – slashed from 18% to 5%.

- Agricultural and forestry machines for soil preparation, cultivation, harvesting, and threshing – reduced from 12% to 5%.

Healthcare Costs Reduced

Medical and healthcare items will now be more accessible:

- Individual health and life insurance – tax removed entirely (18% to Nil).

- Thermometers – reduced from 18% to 5%.

- Medical-grade oxygen – brought down from 12% to 5%.

- Diagnostic kits and reagents – lowered from 12% to 5%.

- Glucometers and test strips – reduced from 12% to 5%.

- Corrective spectacles – slashed from 12% to 5%.

Affordable Education

Education-related supplies are now exempt, making schooling cheaper:

- Maps, charts, and globes – reduced from 12% to Nil.

- Pencils, sharpeners, crayons, and pastels – down from 12% to Nil.

- Exercise books and notebooks – reduced from 12% to Nil.

- Erasers – cut from 5% to Nil.

Automobiles Made More Accessible

Consumers will benefit from reductions in mobility-related taxes:

- Petrol & petrol-hybrid, LPG, and CNG cars (up to 1200 cc & 4000 mm) – reduced from 28% to 18%.

- Diesel & diesel-hybrid cars (up to 1500 cc & 4000 mm) – cut from 28% to 18%.

- Three-wheeled vehicles – down from 28% to 18%.

- Motorcycles (350 cc & below) – reduced from 28% to 18%.

- FeMotor vehicles used for goods transport – cut from 28% to 18%.

Electronics and Appliances See Tax Relief

Durables and household appliances get cheaper:

- Air conditioners – reduced from 28% to 18%.

- Televisions above 32 inches (including LED & LCD TVs) – down from 28% to 18%.

- Monitors and projectors – cut from 28% to 18%.

- Dishwashing machines – reduced from 28% to 18%.

Process Reforms for Businesses

Alongside rate rationalisation, GST 2.0 also introduces ease-of-doing-business measures:

- Automatic registration within three working days, identified through system-based data analysis.

- Taxpayers with an annual turnover below ₹2.5 lakh opting for the scheme will face simplified procedures.

- Refund process streamlined: provisional refunds sanctioned by officers through system-based evaluation, especially for zero-rated supplies and cases with inverted duty structure.

A Reform for Every Indian

The Next-Gen GST reform ensures that families save more on essentials, farmers spend less on equipment, patients access affordable healthcare, and students receive education tools tax-free. At the same time, the rationalised system promises clarity for enterprises and fairness across sectors.

With its launch timed ahead of the festive season, the reform is expected to boost consumption, encourage compliance, and reinforce India’s growth story.

Read More: News