While the Indian Tourism and Hospitality industry recovered significantly in 2021, the year was not without pandemic-related setbacks reveals a study by Noesis, India’s leading hotel investment advisory firm in its Indian Tourism and Hospitality performance report 2021.

Travellers and hotel industry players, on the other hand, continued to adapt to the changing scenario and find new methods to move forward. Driven by a strong recovery in demand, average room rates began to improve after the second wave and gradually approached pre-COVID levels.

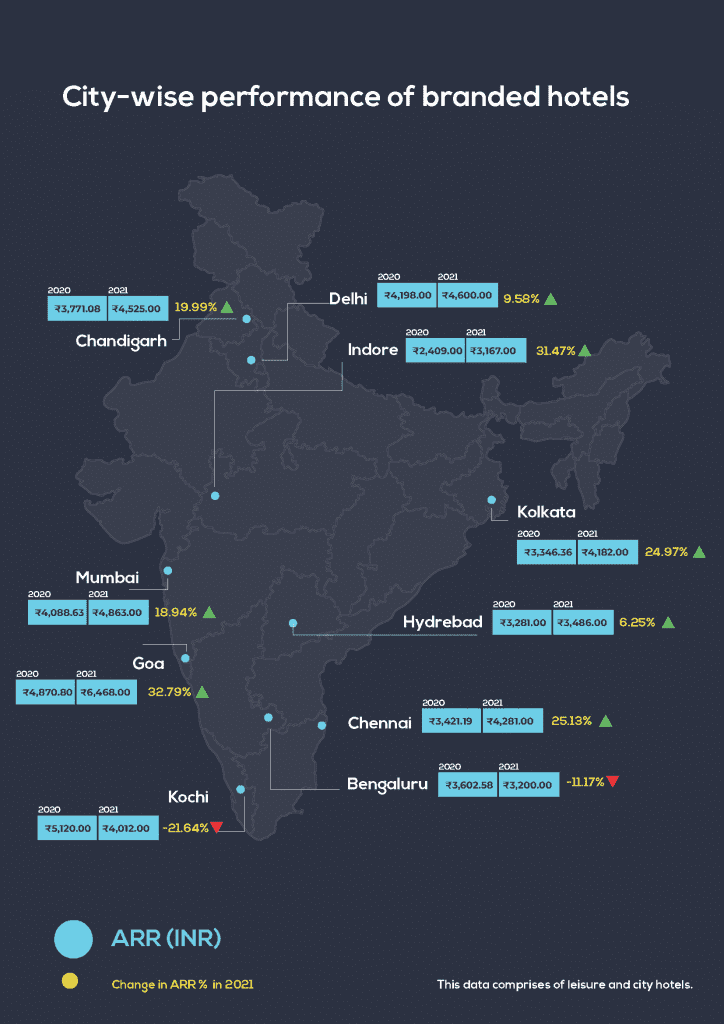

The ARR was in the range of Rs 4,300-4,600, while the ARR in the fourth quarter was in the range of Rs 5,300-5,500, reaching almost 90% of the pre-COVID level.

India’s top leisure and business destinations saw a surge in room rates during the third and fourth quarters of 2021.

Wedding, workcations, and staycations fuelled the growth for these destinations while in destinations such as Udaipur and Goa while in Jaipur and Agra the focus was on improving the room rates.

The year 2020 saw many factors affecting various businesses, while 2021 was a year of optimism, survival and revival. The relaxation of certain travel restrictions and Covid SOPs and an intensive vaccination drive, together with the execution of the right measures and strict Covid SOP followed by the hospitality industry has boosted the confidence of the traveller’s community.

“Despite the fact that foreign travel restrictions have had an impact on enterprises, domestic travel is driving the recovery. Demand has surged in the leisure and homestay segments as travellers want to go a small distance to escape the congestion and immerse themselves in experiential stays, ” says Nandivardhan Jain, CEO, Noesis.

He added, ” While hotels in metro areas across all categories are maintaining average rates and are predicted to return to normal by the end of 2022. The omicron crisis has significantly lowered previously improving business traveller attitude, resulting in a major drop in occupancy across the country in the final week of December”,

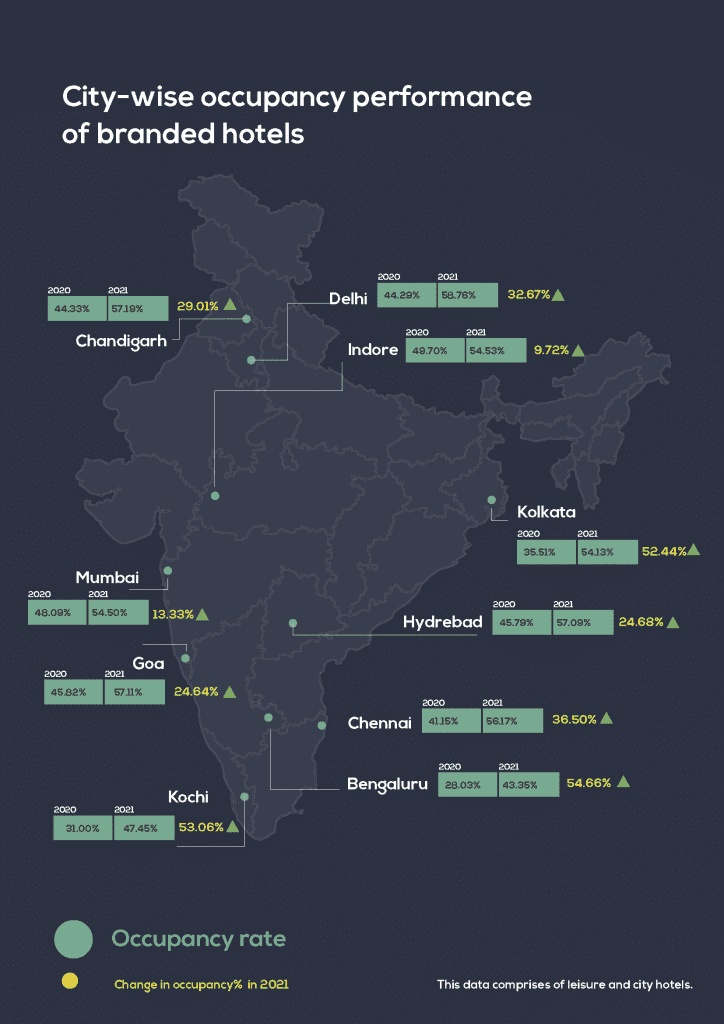

The impact of COVID-19 on the Indian hotel sector was such that India’s average occupancy was at 65 per cent in 2019, but it plummeted to as low as a single digit in some months and locations throughout 2020 and 2021, greatly hurting the industry’s overall performance. In 2020, foreign tourist arrivals (FTAs) decreased by 75.5% YoY to 2.68 million and arrivals through e-Tourist Visa (Jan-Nov) decreased by 67.2% YoY to 0.84 million In India.

The Indian hospitality industry is set to expand at a pace of 10.35% between the years 2019 to 2028. It is projected that the Indian travel market will be worth USD 125 billion by the year 2027.

While the year saw 110 properties that have opened in various parts of the country while there were 161 hotels signed in the same year. The report also portrays future trends which would shape the hotel industry, such as leisure, staycation, local experience, enhanced digital guest experience, virtual & augmented reality, robot staff, sustainability and many more.

Highlights of Noesis’s Indian Tourism and Hospitality performance report 2021

India has a rich and diverse culture that attracts tourists from all around the world to come and experience the vast opportunities the country has to offer. With a mix of different kinds of tourism, the country can cater to the needs of every type of traveller in the world. As of 2021, UNESCO has recognized 40 World Heritage sites in India. These are places of importance of culture or natural heritage as described in UNESCO’s World Heritage Convention established in 1972.

In India, the industry’s direct contribution to the GDP is expected to record an annual growth rate of 10.35% between 2019 and 2028. The travel market in India is projected to reach US$ 125 billion by FY27.

The Indian airline travel market was estimated at USD 20 billion and is projected to double in size by FY27 due to improving airport infrastructure and growing growth and success of low cost and budget airlines.

In 2020, foreign tourist arrivals (FTAs) decreased by 75.5% YoY to 2.68 million and arrivals through e-Tourist Visa (Jan-Nov) decreased by 67.2% YoY to 0.84 million In India, the percentage share of FTAs was highest at Bengaluru Airport (29.96%),

followed by Mumbai Airport (17.48%), Ahmedabad Airport (15.72%), Delhi Airport (9.21%), Cochin Airport (4.91%), Chennai Airport (4.04%), Hyderabad Airport (3.34%), Lucknow Airport (2.40%), Bhavnagar Seaport (2.37%), Kolkata Airport (2.11%), Calicut Airport (1.41%), Amritsar Airport (1.35%), Kakinada Seaport (1.32%), Dabolim (Goa) (0.91%) and Mangalore Airport (0.72%) in April 2021.

While there was significant recovery, the year was not without pandemic related setbacks, as the emergence of new COVID variants acted as temporary roadblocks in the sector’s recovery. Top leisure destinations during the third and fourth quarters of 2021 rebounded back aggressively. Business destinations in India saw (except Ahmedabad and Pune) an improvement in demand primarily led by small conventions as well as events that have shifted to star category hotels due to their health and safety standards.

The pandemic has left the country inducing a new culture of work from home in our corporates permanently changing the whole scenario of operations for hotels across business destinations.

Looking at the demand trend at leisure destinations, many hotel operators are evaluating niche leisure destinations for their

expansion plans for the next 2 years and are more focused on brown-field and conversion projects than greenfield developments.

There is a significant interest from the hotel developers and investors to invest and develop resorts in leisure destinations that are at a drivable distance from the top metro cities. Markets like Lonavala, Igatpuri, Alibaug, Coorg, Mysore, Kevadia (Statue of Unity), Kasauli, Goa, and Udaipur are the key markets and will witness decent supply additions in the next 3-5 years.

Read more: News